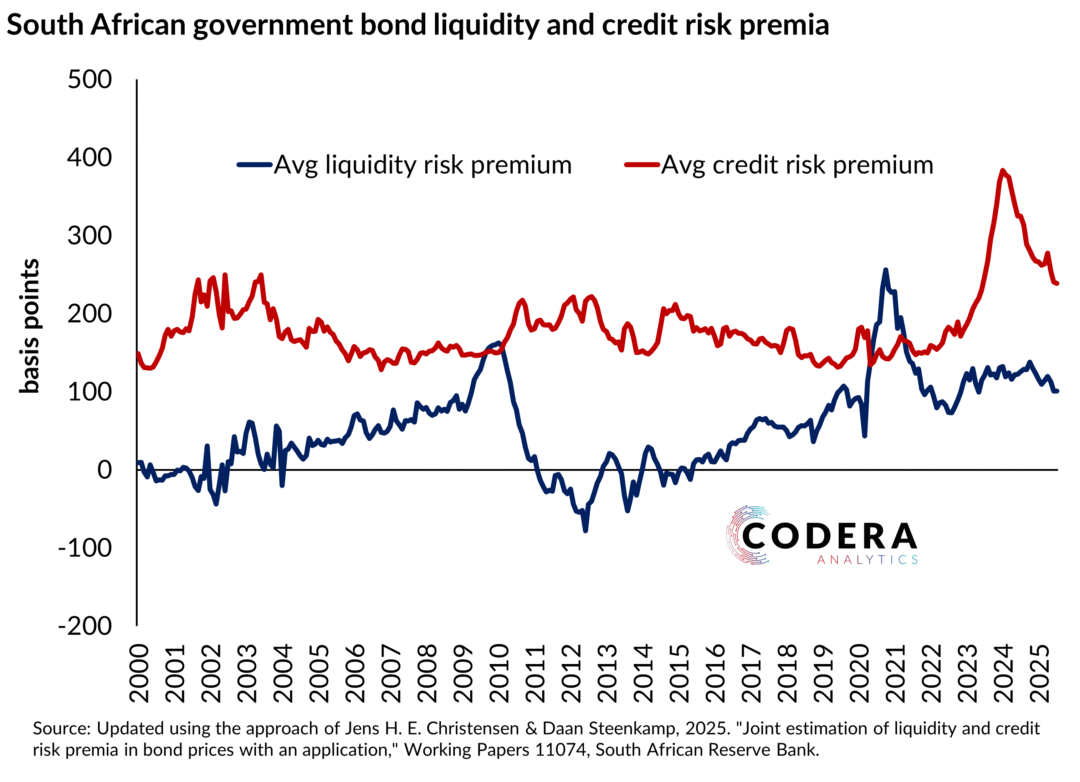

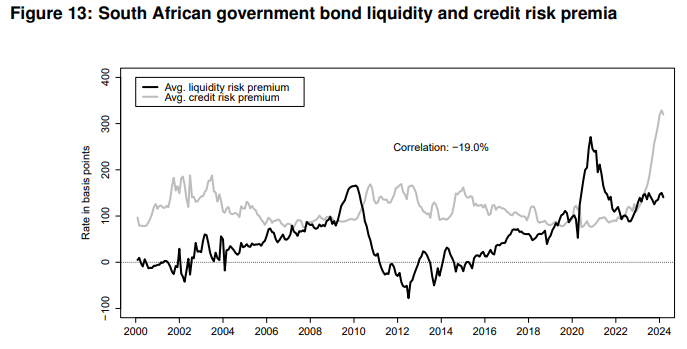

In a new paper, Jens Christensen and I introduce a novel arbitrage-free dynamic term structure model that jointly accounts for liquidity and credit risk premia. We find that increases in bond market liquidity and government credit risk premia contributed to higher South African sovereign borrowing costs over the last decade.

Our results support the view that the financial market turmoil surrounding the global financial crisis and the COVID-19 pandemic and associated spikes in South African bond yields mainly reflected global financial market illiquidity and flight-to-safety or flight-to-cash effects and had little, if anything, to do with the ability of the South African government to honour its promised debt payments. In contrast, the recent spike in the credit risk premium seems tied to the increase in the South African government debt-to-GDP ratio. This higher perceived level of credit risk also seems to have influenced investors’ perceptions about the future liquidity in the South African government bond market, causing them to demand notably

higher liquidity risk premia.