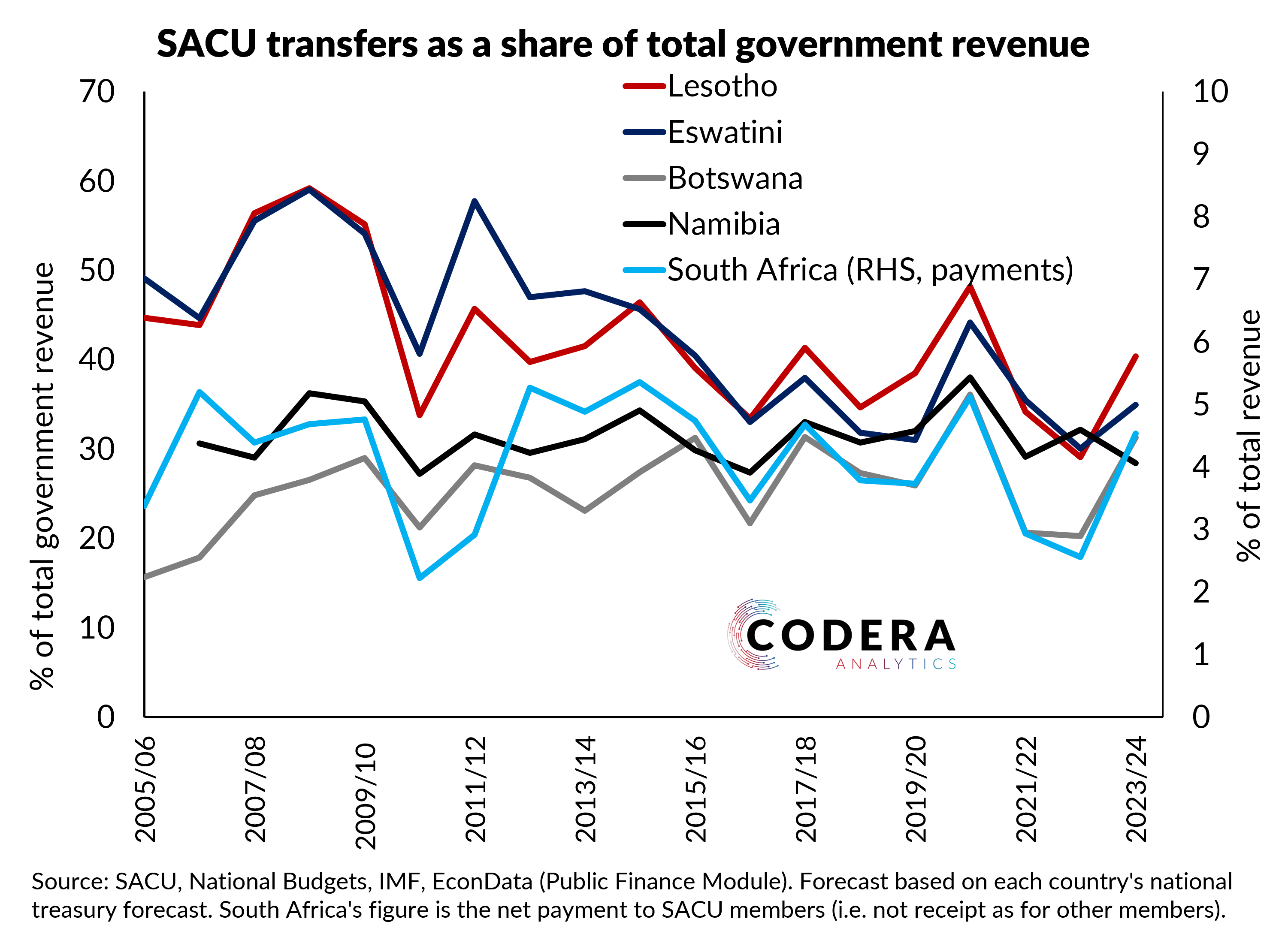

Botswana, Eswatini, Lesotho and Namibia receive a large proportion of their total government revenue from transfers from the Southern African Customs Union (SACU). Since 2010, for example, Eswatini and Lesotho have received almost 40% of their total government revenue from SACU. For South Africa, on the other hand, SACU transfers are costing South Africans almost 5% of our total government revenue.

Are such large transfers justified on the basis of the trade generated by these countries? DNA Economics estimated in a counter-factual exercise to determine what each economy would collect in customs duties if SACU did not exist and suggest the following:

- South Africa would retain 96% of customs duties collected, whereas the current SACU customs sharing formula allocates the other SACU members more than 83% of import duties.

- To achieve their 2014 allocations outside of SACU, their their individual aggregate tariff rates on imports would need to be between 7 and 34 times higher.

What would ‘fair’ customs transfers to the SACU members look like? There are two important economic considerations that matter for trying to answer this question. South Africa, for example, provides trade protection to our domestic motor assembly industry, and this raises import prices for the other SACU members. Being part of SACU also encourages SACU members to import from high-cost South African producers instead of importing from lower-cost producers overseas because of the tariff protection applied on imports. DNA calculated ‘fair’ compensation for members that tries to account for the trade diversion and price raising effects of being part of a customs union. Their estimates suggest that ‘SACU customs distribution may be close to four times more than what might be considered fair’ and for Eswatini ‘this may be more than six times the estimate of fair compensation’.