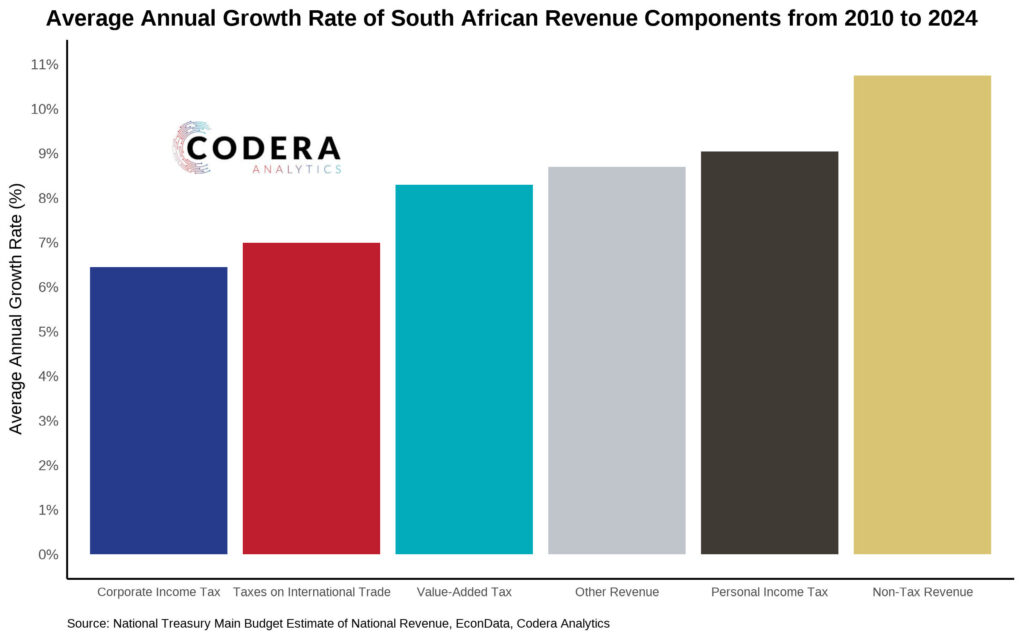

Today’s post shows that personal income tax and value added tax (VAT) revenues represent almost 75% of South Africa’s total tax take. As we have noted previously, an increase in the personal income tax has driven an increase in tax burden in South Africa. But non-tax revenue (things such as administrative fees, fines and penalties, rents on public land, and sale of goods of services by departments) has grown even faster.

Compiled by Sinead Morrow