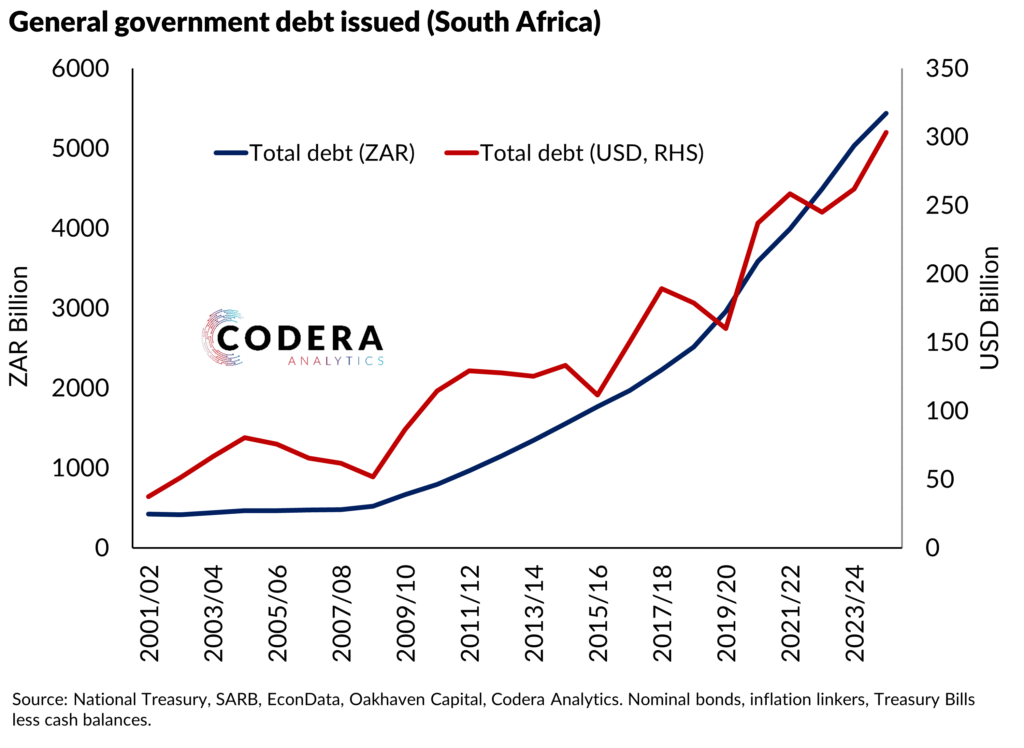

South Africa’s total stock of issued government debt has risen by 12.4% per year at a compound annual growth rate since 2002/3. Today’s post shows that exchange rate depreciation and inflation have also meant that the stock of debt has also risen dramatically when converted into current us dollars. The capacity of the economy to service this debt has been weakening, especially in foreign currency or purchasing power terms (see here and here). Higher debt levels also create challenges for the inflation targeting framework from higher exchange rate depreciation risk (see here and here). As we have argued in our paper on the transition to a lower inflation target, reducing the growth rate of debt is going to be key to a successful reduction in the inflation target.