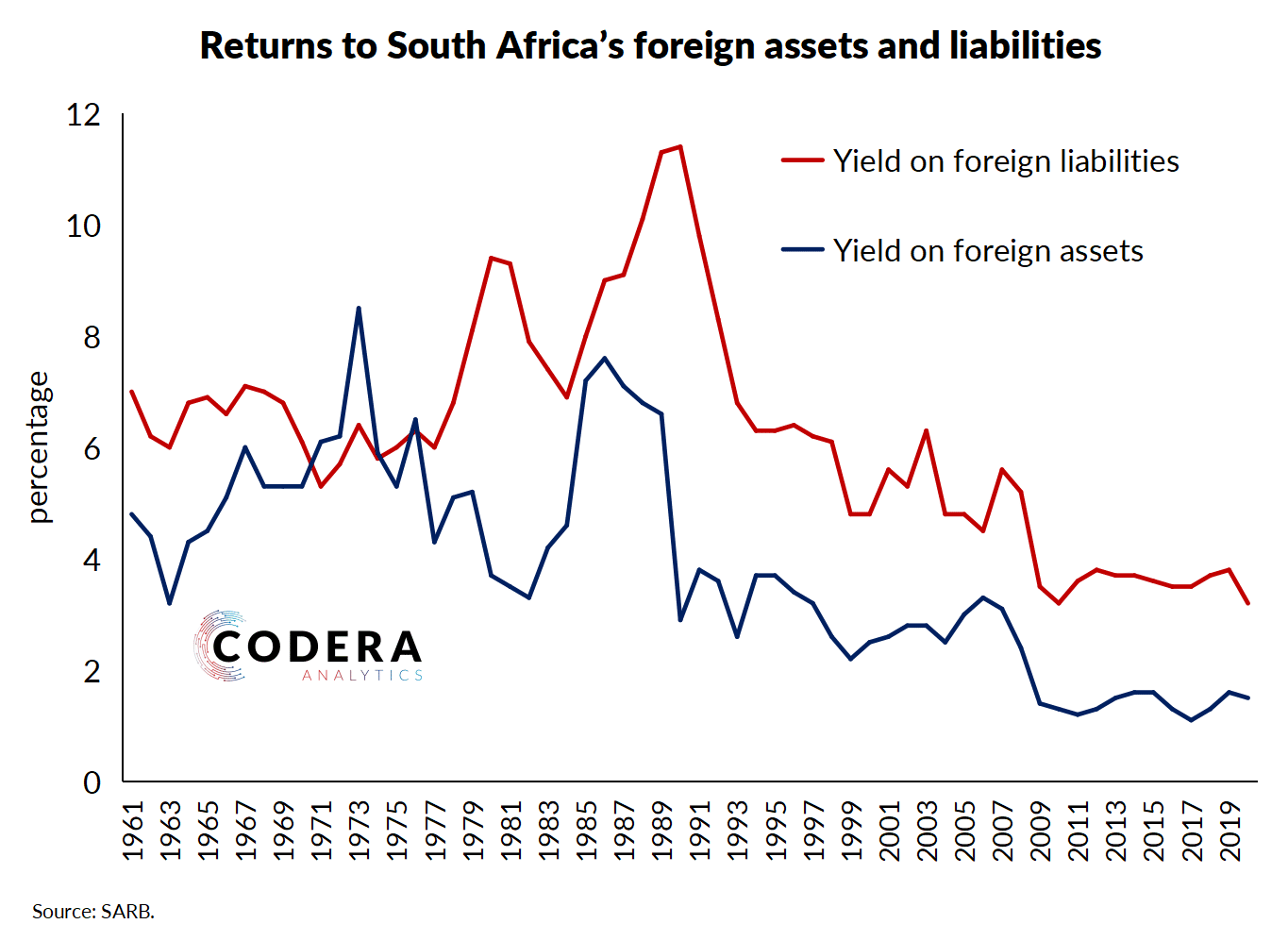

The yield on South Africa’s foreign liabilities has tended to exceed that on its foreign assets by a large margin. This reflects the excess yield on direct and non-direct (portfolio and other investment) assets in South Africa over the yield on South African assets abroad. This reflects relatively high profitability of certain domestic corporates (think Naspers), high relative inflation, expectations of exchange rate depreciation and higher domestic risk premia.