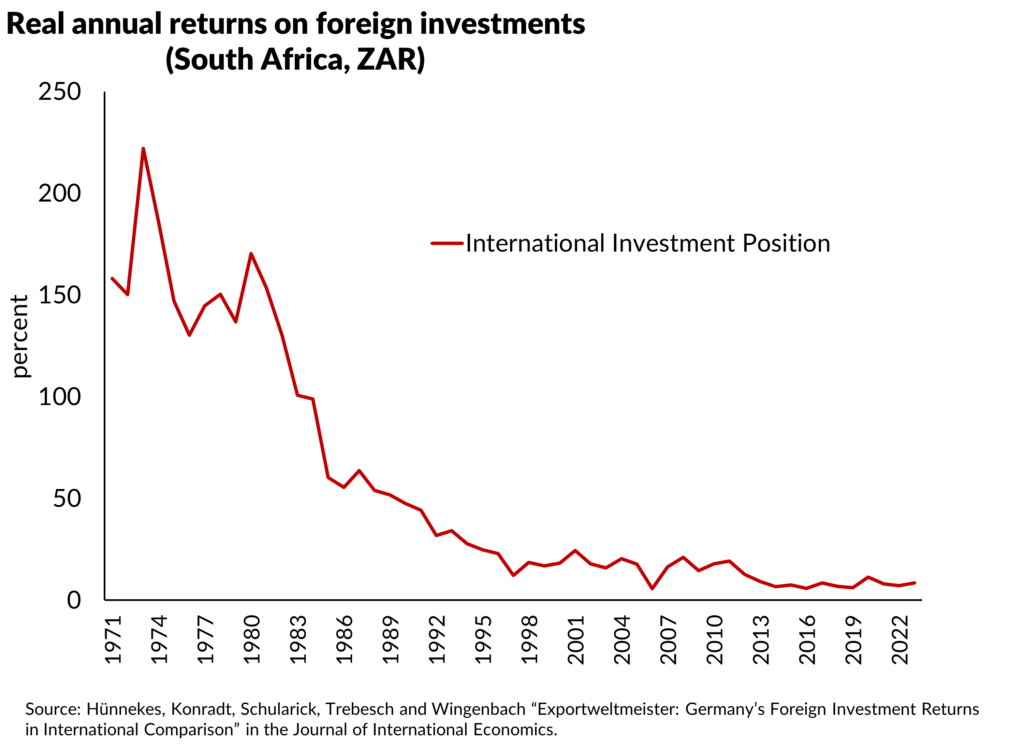

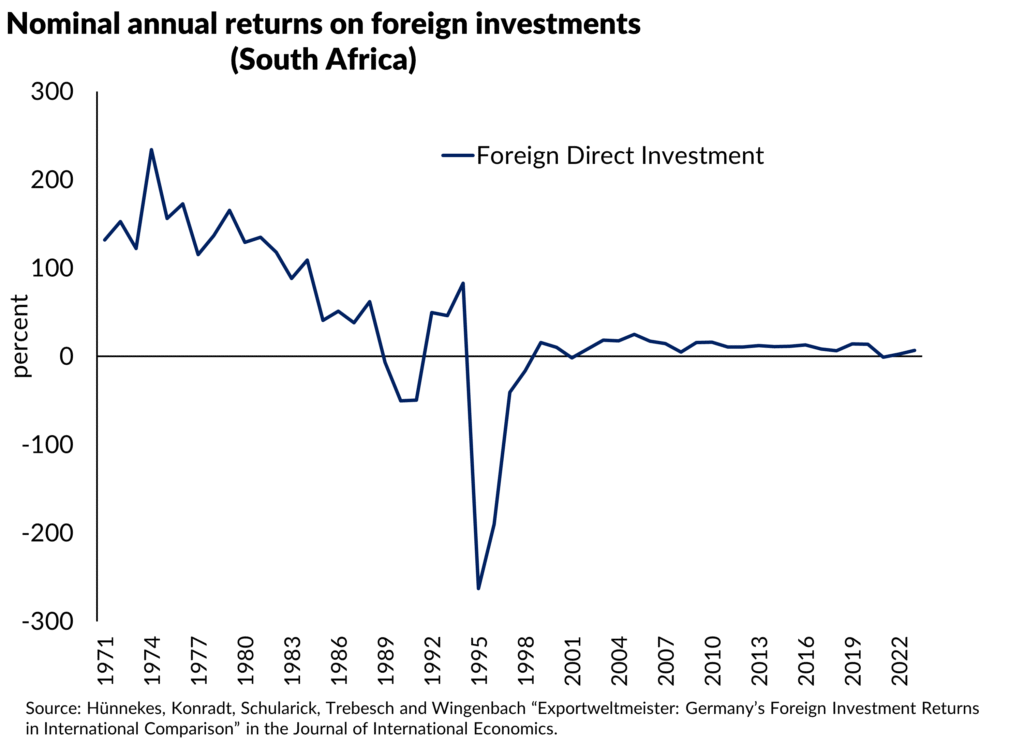

A new dataset of foreign returns of nations provides long term estimates of real local currency returns to South Africa’s international investment portfolio. Today’s post shows that, according to Hünnekes et al (2025), there has been a dramatic decline in yields over time. Much of the nominal decline reflects lower inflation and global interest rates.

It is worth pointing out that over the long term, the yield on South Africa’s foreign liabilities has tended to exceed that on its foreign assets by a large margin. This reflects the excess yield on direct and non-direct (portfolio and other investment) assets in South Africa over the yield on South African assets abroad. This reflects strong price increases in South Africa’s foreign assets (think the performance of Naspers’ global internet investment business) and favourable valuation changes from exchange rate changes (rand depreciation boosting the rand value of foreign currency denominated foreign assets). When it comes to equities, the S&P 500 provided higher returns at relatively lower risk than the JSE All Share in USD terms since 2010. In ZAR terms, the S&P also had higher returns, although the volatility of returns has been higher.

This is why, despite a long history of twin deficits (fiscal and current account deficits), South Africa’s net international investment position remains in positive territory.