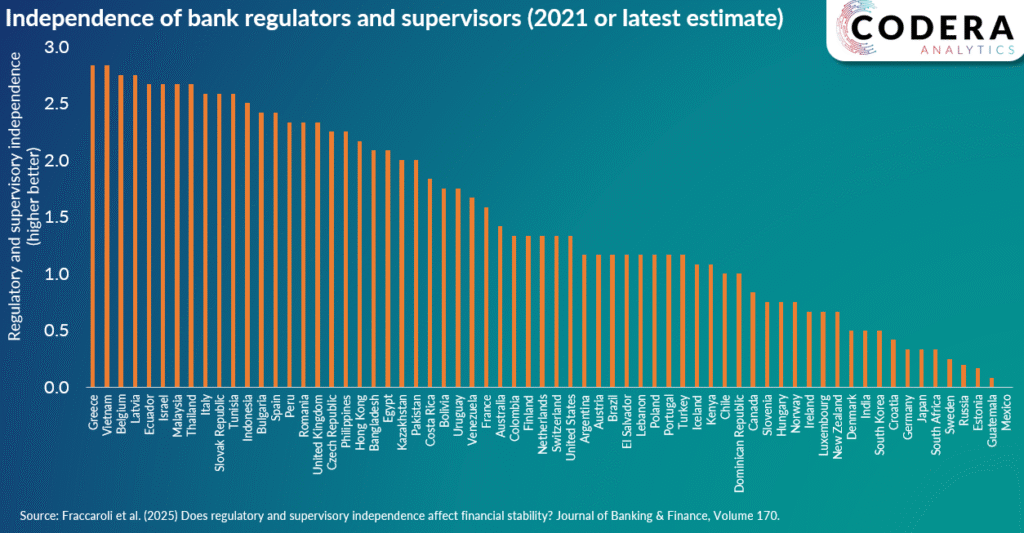

A new paper in the Journal of Banking & Finance provides a measure of the political independence of bank regulators and supervisors across countries and shows that higher independence is associated with improved financial stability. The measure is based on institutional independence (based on things like the appointment, removal, and term length of the head of the supervising agency), regulatory independence (including the degree of autonomy in setting technical rules and regulations for the sector it regulates and supervises) and budgetary independence (measuring how independent the supervisor is in determining its own resources).

The paper shows that countries with higher independence of regulators and supervisors have banking systems with lower levels of nonperforming loans, lower insolvency risk and lower volatility of return on assets. South Africa’s rank is surprisingly low at only 61st out of 68 countries, especially given SARB’ extraordinary budgetary independence. It is also notable that the authors’ regulatory and supervisory independence score for South Africa is unchanged between 2003 to 2018.