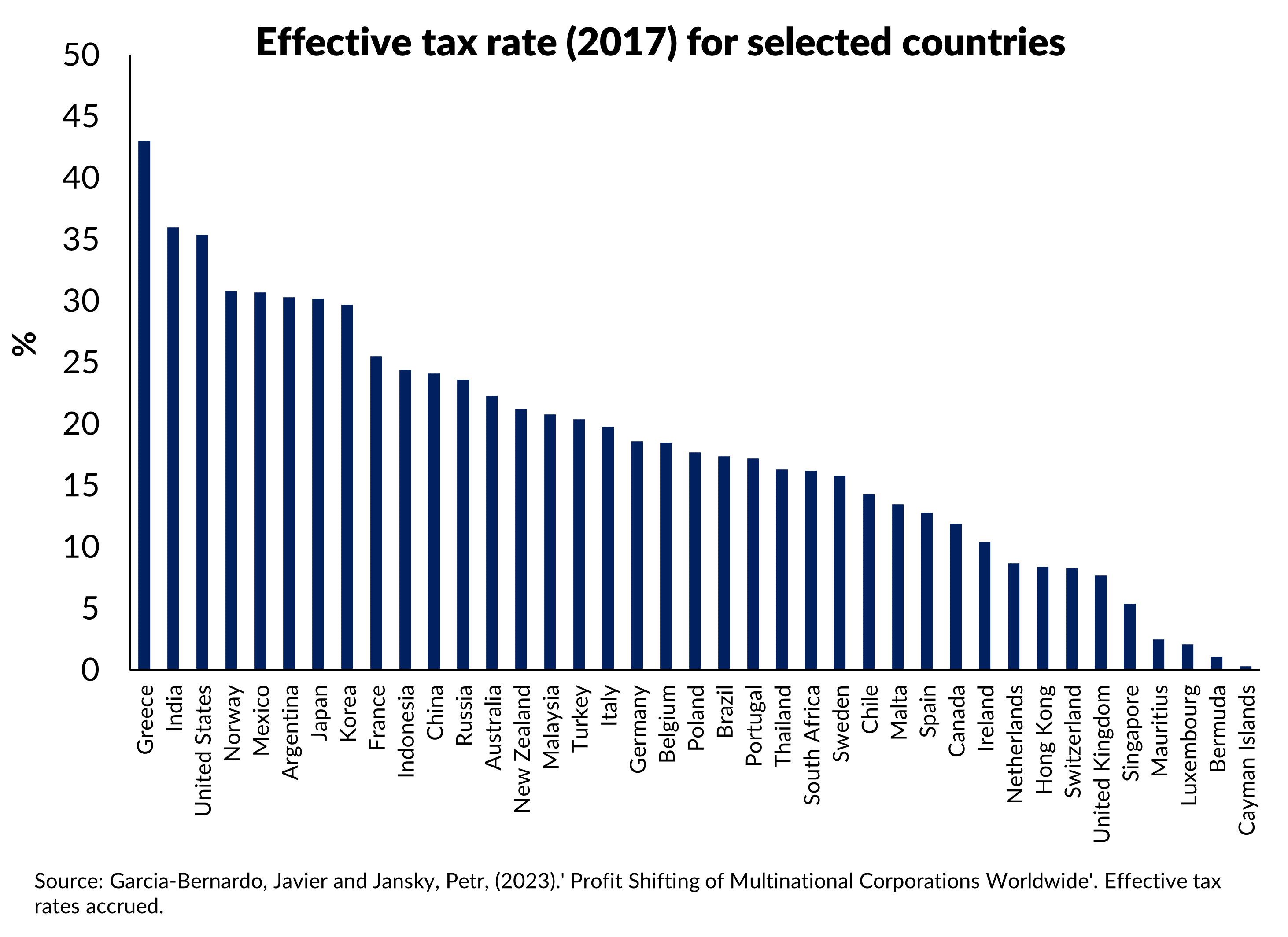

We showed in an earlier post that Wier and Zucman (2022) estimated that about 9% of South African corporate tax receipts have been shifted to tax havens. A new paper by Garcia-Bernardo and Janský however finds little evidence of profit shifting towards tax havens by multinationals headquartered in South Africa. South Africa’s effective tax rate, defined

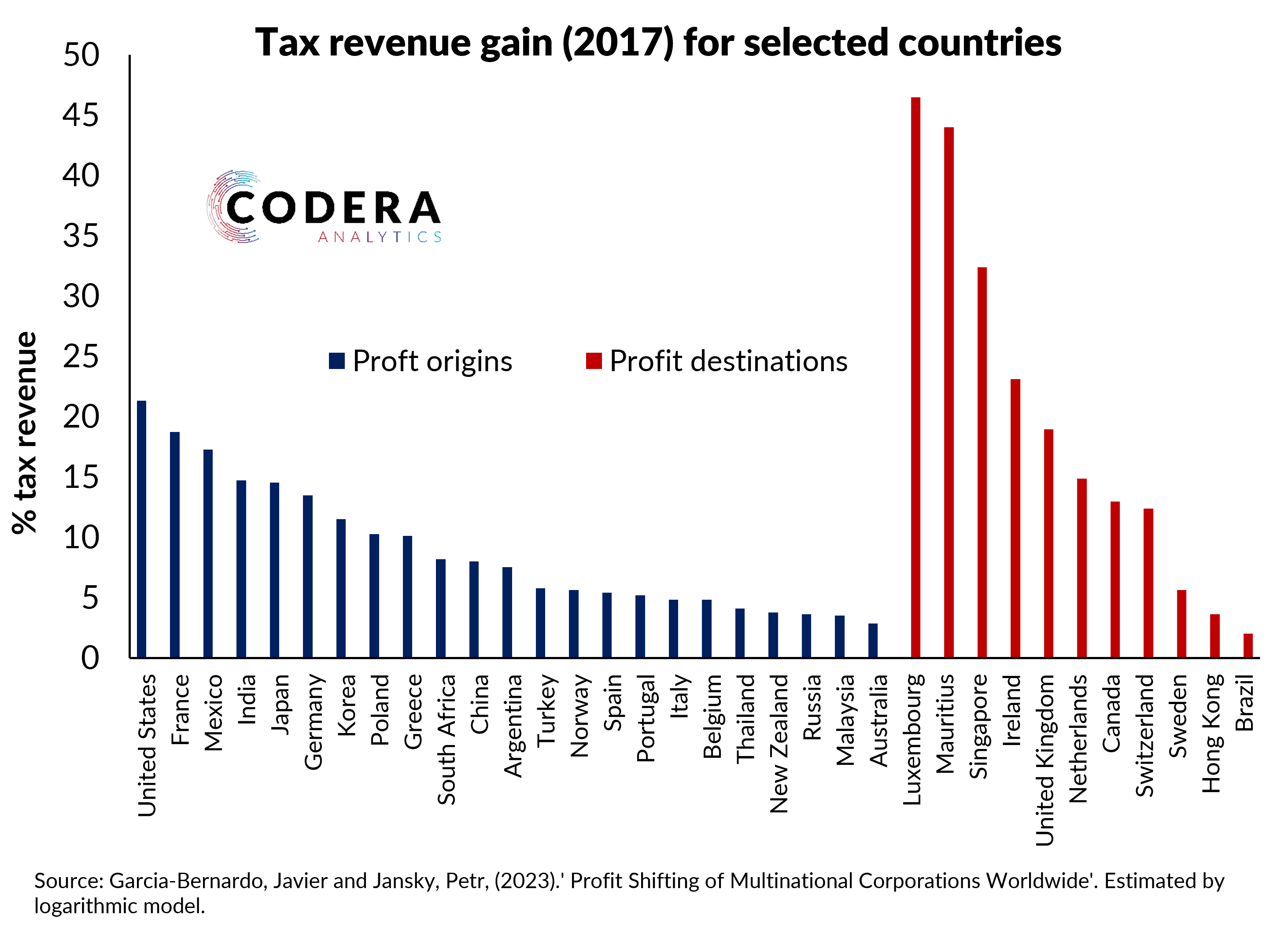

as the ratio of accrued taxes over profits, is around the middle of the pack for major markets at about 16%. Overall, effective tax rates, are found to be quite different from statutory rates – for Luxembourg the effective rate is 1% compared to around 29% in 2017. The largest destinations of shifted profits are countries such as the Cayman Islands, Luxembourg, the Netherlands, Switzerland, Singapore and Bermuda. Multinationals headquartered in the US, Brazil and Singapore are found to be the most aggressive in terms of profit shifting. Interestingly, among major advanced economies, multinational companies in the UK are estimated to be recipients of profits (given the UK’s low tax rate), while the US is estimated to suffer the most from profit shifting in absolute terms and Germany and France are estimated to lose almost half of their profit base.