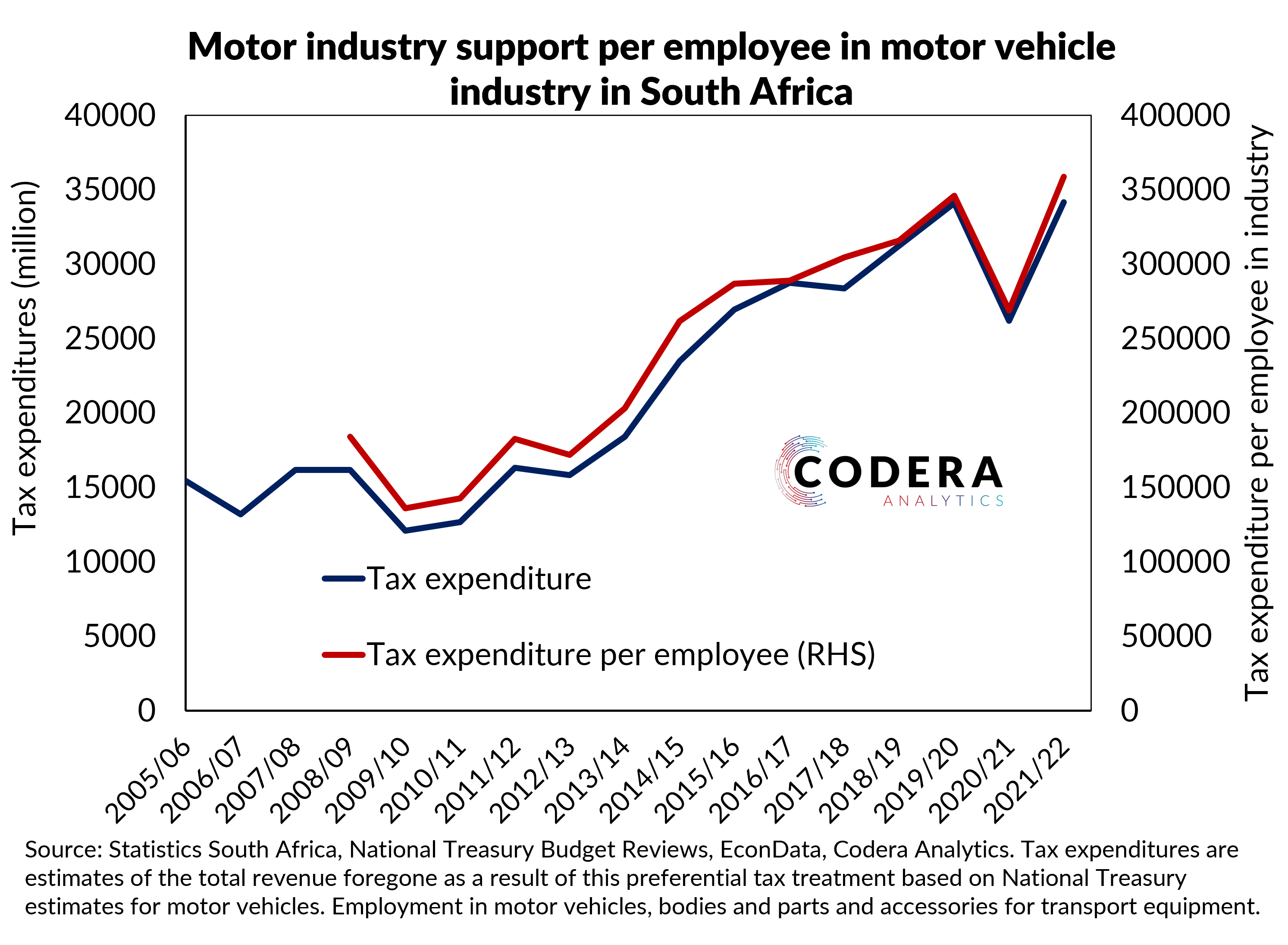

The vehicle manufacturing industry in South Africa is relatively small, contributing around 0.9% to our GDP. Yet the automotive industry receives substantial preferential tax treatment, costing the fiscus almost R35bn in foregone tax in 2022 (around 0.5% of GDP). To get a back-of-the-envelope sense of the extent of the support the industry receives, one can compare the foregone customs duties to the number of employees in the industry. The motor industry directly employees around 35 000 employees with a further 60 000 employees in manufacture of bodies and parts and accessories, implying a per job implied cost of around R350 000.