The Department of Social Development launched a Modelling Report on basic income support in South Africa today. Empirical work on the issue of transfers is very important for informing public debate on the policy options for addressing poverty, inequality and unemployment. But there are several aspects of the study that limit its usefulness in informing this discussion. Models of the type used in that study have a major shortcoming: they cannot assess the long-term implications of policy changes or incorporate the inevitable effects of the assessed policy changes on interest rates, inflation or investment in their analysis. This limits the ability of the framework used to assess the costs and benefits associated with changes in basic income support that require meaningful changes in fiscal settings or their impacts on macroeconomic stability. Although this point is acknowledged by the panel (in bullet 37 in their report), this does not stop them from proposing permanent policy changes that their modelling approach cannot be used to reliably inform.

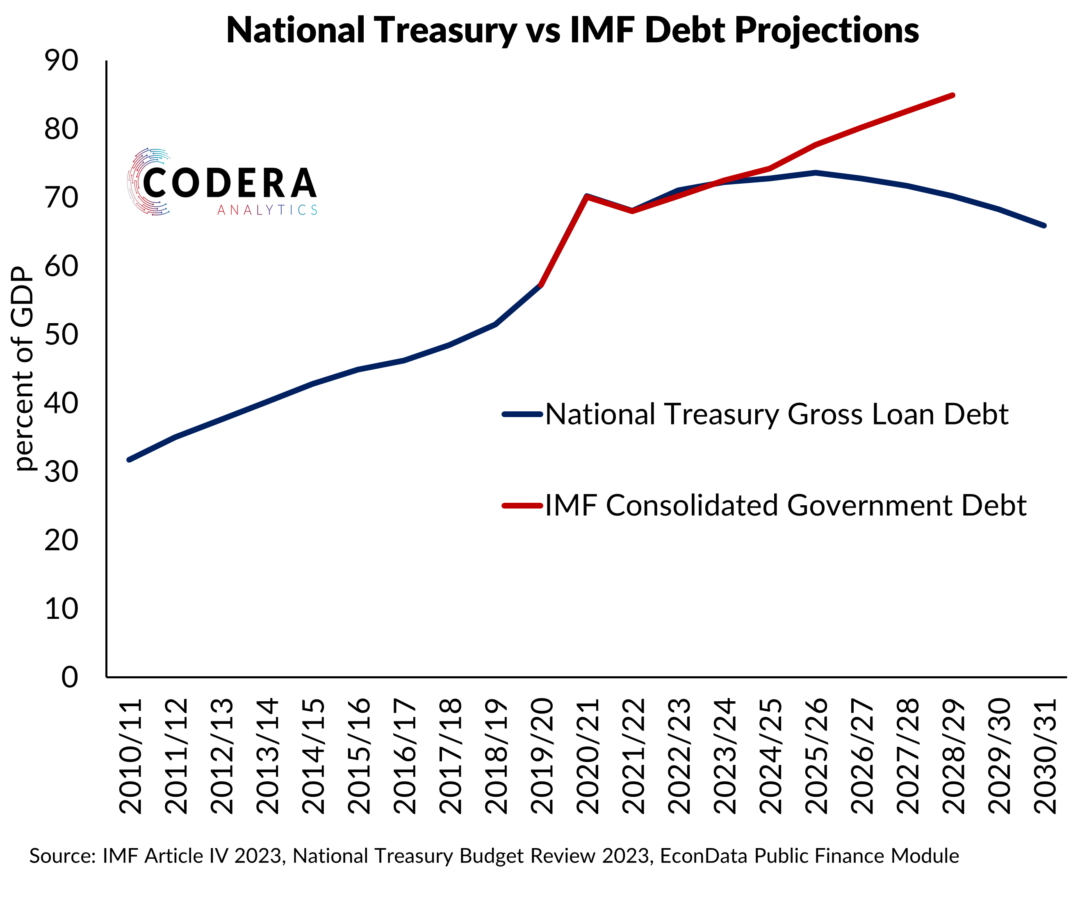

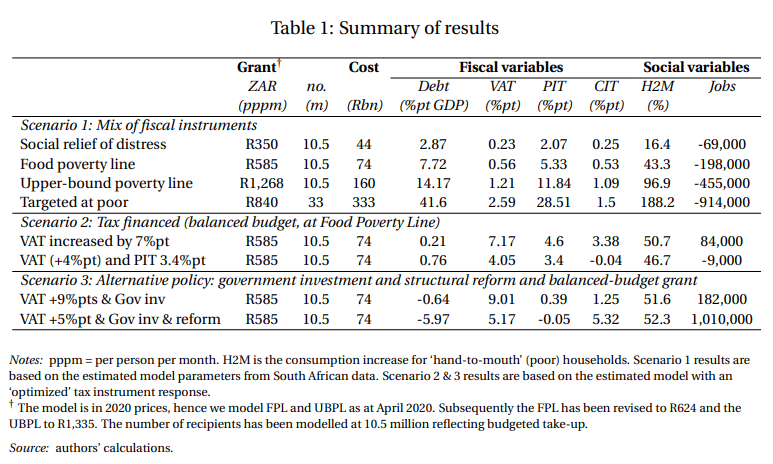

The policy proposals in the Department of Social Development paper imply meaningfully higher expenditure over the long-term. We estimate that an extension of the SRD grant would cost an addition 0.8% of GDP per annum, while their proposed extension to the lower bound poverty line would cost 2.3% of GDP per annum. Our modelling, which allows for assessment of the impacts of fiscal settings on interest rates and the macro economy over the long-term, suggests that accommodating the proposed increases in transfers would require a combination of several forms of funding. These would include government debt increases of between about 3 and 8% of GDP, VAT increases of between 0.2%pt and around 0.6%pt and personal tax increases of between 2 and about 5.5%pt and between 0.25%pt and around 0.5%pt higher corporate tax rates. Tax increases of these estimated magnitudes would likely lead to meaningful job losses and would dominate any expansionary effects from higher transfers.

Let us use some ‘simple sums’ to demonstrate the implications of permanently higher expenditure for taxpayers. With 7.4 million taxpayers, and 10.5 million potential SRD-350 recipients, this implies about 1.5 grant recipients for every taxpayer in South Africa. Thus each taxpayer needs to contribute 1.5 times the value of the grant to balance the budget. The SRD expansion proposed in the Department of Social Development paper amounts to the average taxpayer paying an additional R6,800 per year. For the average taxpayer, this is around a 9% increase in tax. For those in the biggest tax bracket by number (R500,000 to R750,000), the average taxpayer in this bracket will pay R11,855 per year more in tax.

Although extending the SRD grant is fiscally feasible, proposals for enhanced social support need to consider the long-term sustainability of higher expenditure, debt and taxes. Such proposals also need to be compared to alternative policies to assess whether there are other more cost effective ways to address South Africa’s socio-economic challenges.

As we argue in our paper, South Africa has a small tax base with limited fiscal space for expansionary policies. Our modelling suggests the tax increases required to finance increased spending would imply fewer jobs and slower economic growth. Sustaining extensions of public spending of the size proposed over the long-term would require either a clear, credible commitment to cutting other spending or structurally higher economic growth.

Economic models often disagree about likely impacts of policy changes. But such frameworks are important cross-checks of the sustainability of policy settings. Macroeconomic assessments of policy changes need to consider the impact on borrowing costs and growth over at least a 5 to 10 year horizon. The recent financial market turbulence after the UK’s announcement of unfunded expansionary policy demonstrates the danger of trying to pursue unsustainable economic policies.