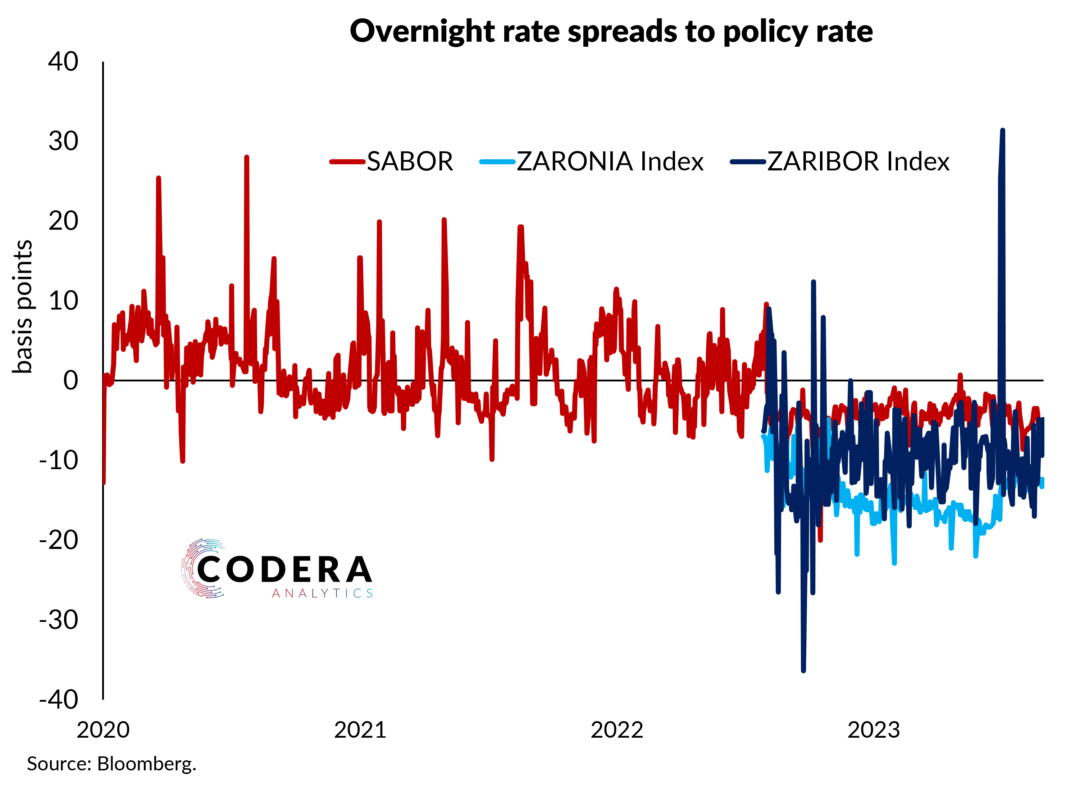

The spreads between the JIBAR and Treasury-bill 3 month rates and the repurchase rate have come down over recent months. Since the beginning of the transition to a new monetary policy implementation framework (MPIF) in SA on 8 June 2022, the spread between the JIBAR and the policy rate has been broadly in line with its average since 2008 (though higher than its average between 2020 and the reform). The recommended spread

under normal conditions should be a maximum of 25 basis points. The spread between the Treasury-bill rate and repo had displayed unusual behaviour, having been negative between late September 2022 and early 2023 (as discussed here and here), but has recently come close to closing. Note that the JIBAR is set to be replaced by a more representative reference rate.

Table: Average spread to policy rate (basis points)

| JIBAR 3M | T-bill 3M | |

| 2008-MPIF reform | 20.54 | 21.29 |

| 2020-May 2022 | 14.77 | 22.87 |

| Since MPIF reform | 20.87 | 0.00 |