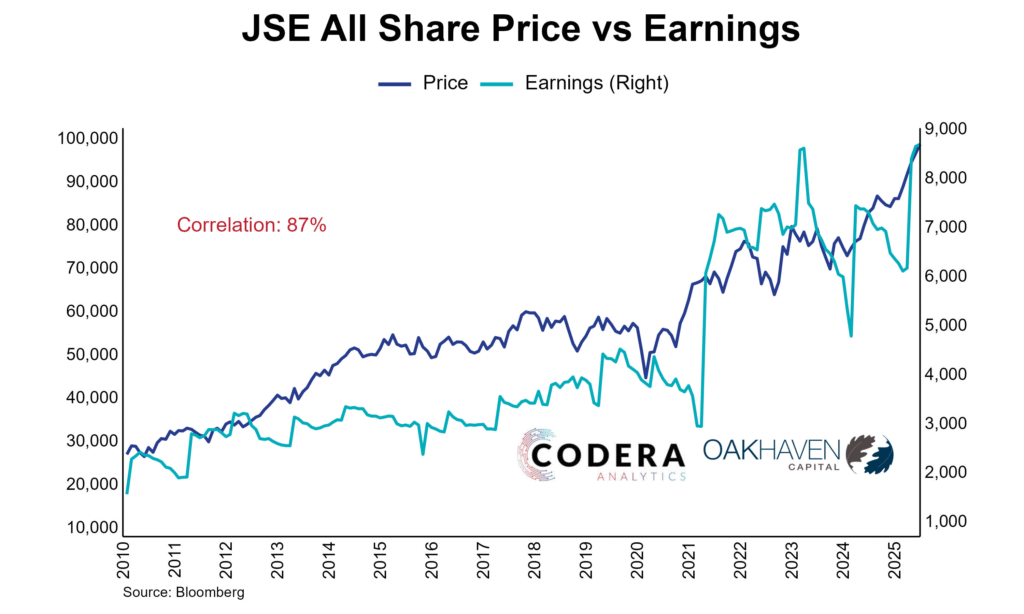

In today’s post by Takudzwa Mutetwa we show that the JSE share price index and earnings series have been highly correlated over time, even if they have diverged meaningfully for long periods. Periods of weak earnings growth have still seen rising prices, underscoring the role of global liquidity and sentiment alongside fundamentals in driving valuations. It is also worth noting the difference to US stock indices, including the S&P, which have in recent years shown a significant gap between prices and earnings, driven largely by the sustained tech boom.