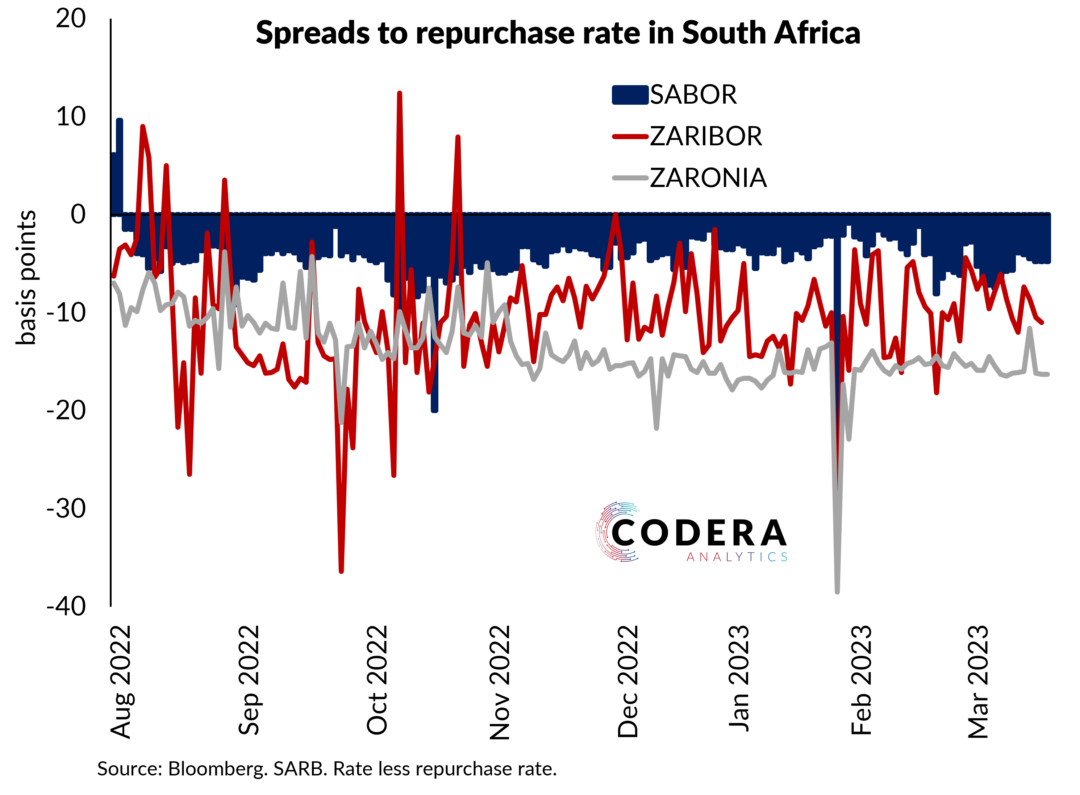

There has been a lot of discussion around seasonality in FX implied rates in South Africa. For much of the period since the start of the pandemic, FX implied rates were also meaningfully higher than the South African policy rate. As discussed in an earlier post, this has been suggestive of a possible oversupply of USD liquidity relative to ZAR liquidity in the forward rate market, which may have been worsened by Basel III banking reforms requiring banks to report on their liquidity position. These regulations create incentives for domestic banks to limit their involvement in the FX swap market around the time of month-end reporting. Corporate shifts in ZAR or dollar funding requirements at quarter-ends may also create seasonal effects in FX implied rates.

The chart below however suggests that the cost of borrowing USD to fund ZAR investments has not generally been higher at month- or quarter-end.