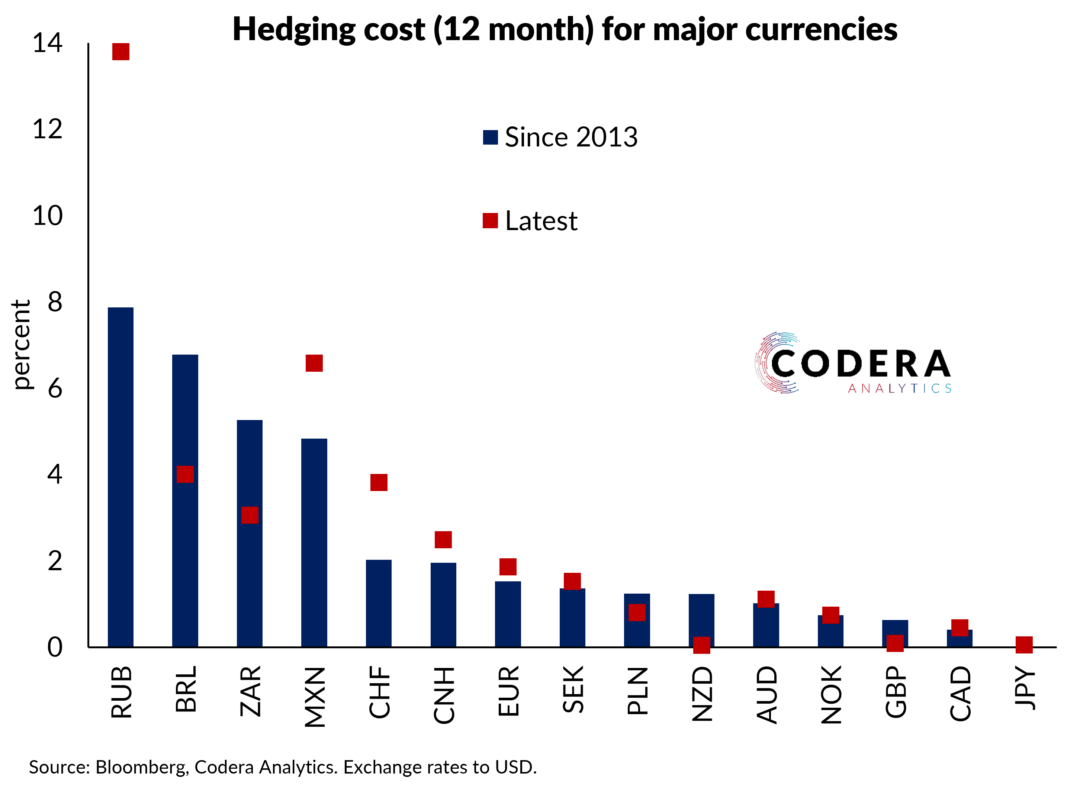

The cost of borrowing USD to fund ZAR investments continues to diverge from the policy rate, which serves as a benchmark for the cost of short-term borrowing in ZAR. This is suggestive of a possible ZAR liquidity shortage in the forward rate market and may create appreciation pressure on the ZAR at the margin. The SARB provided some explanations for the recent upward pressure on FX implied yields in a recent MPR.