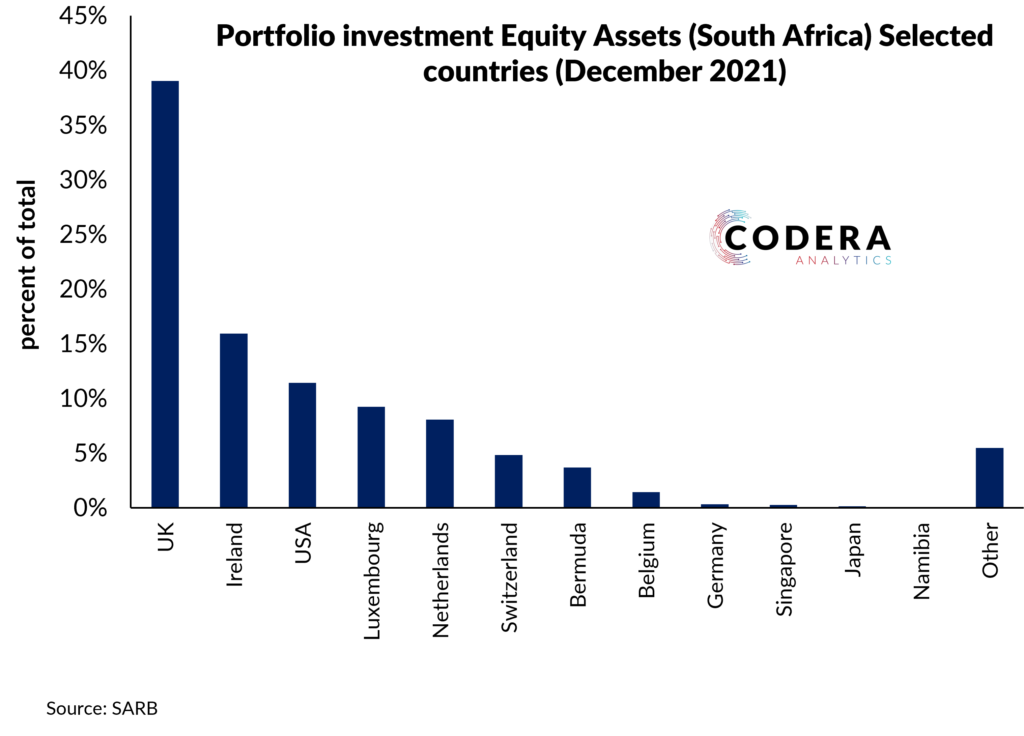

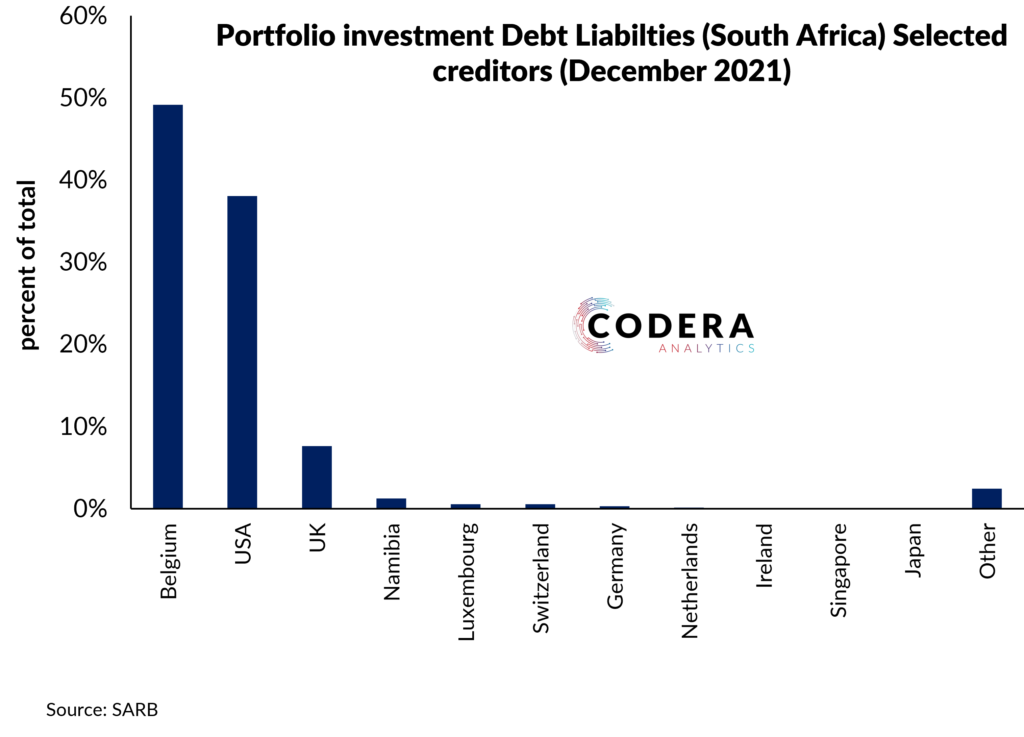

Something that is not commonly appreciated is how regionally concentrated South Africa’s foreign equity portfolio investments are, and how regionally concentrated portfolio investment into South Africa has been.

Portfolio holdings are defined as cross-border positions of tradable debt and equity instruments than are not classified as direct investment or reserve assets. According to the latest data from SARB, the largest share of South Africa’s foreign portfolio assets are invested in the UK in the case of equities, and the USA and UK in the case of debt. The largest counterparties for South Africa’s portfolio liabilities are the USA (for equities) and Belgium and the USA for debt.