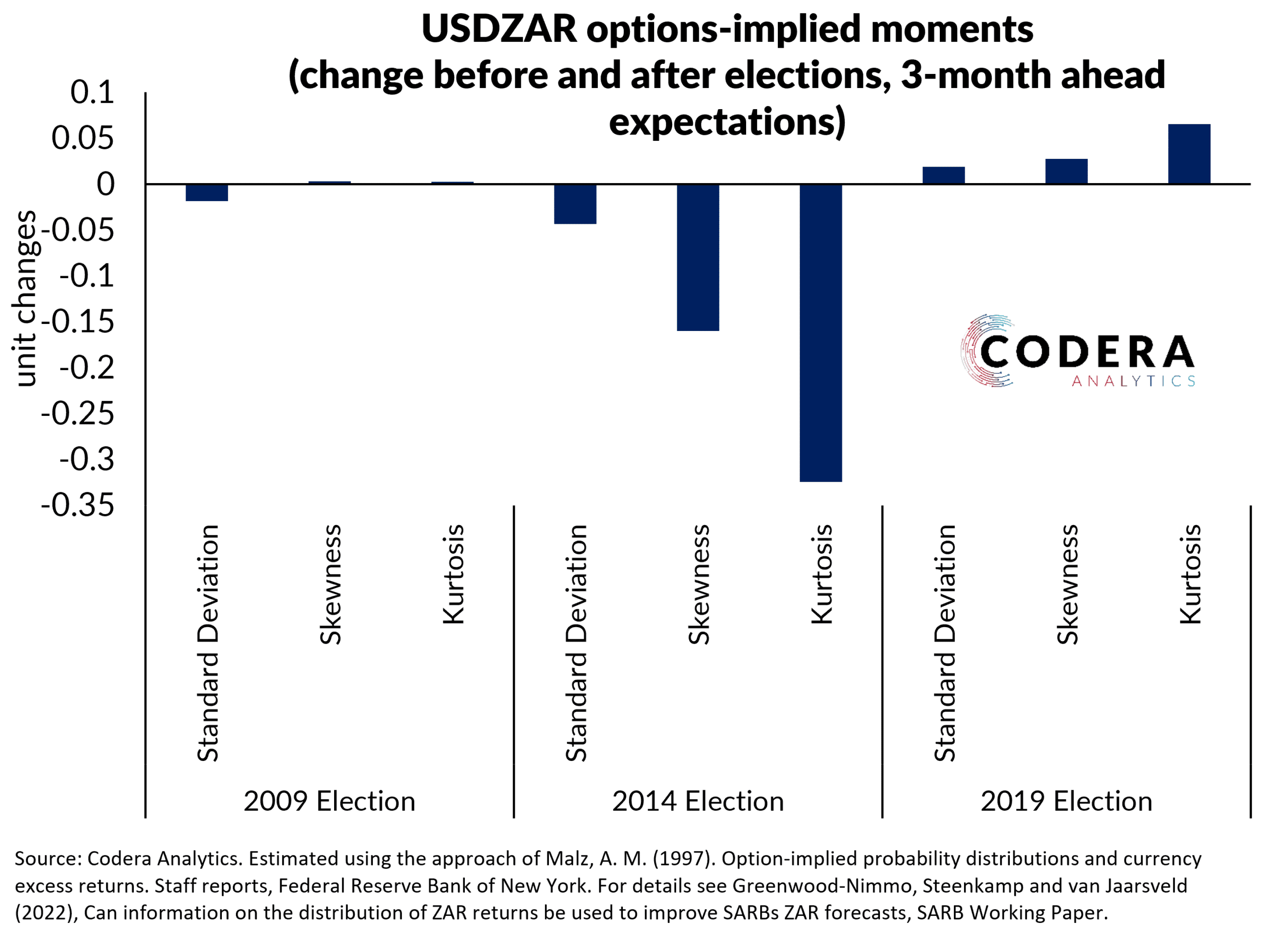

In earlier posts, I have shown how to back out market expectations of future USDZAR movements using options prices and how the option-implied probability distribution of the USDZAR has shifted through time. One useful aspect of FX option-implied moments is that they can show you how events affect expectations of currency uncertainty. The figure below shows that the 2009 election was not associated with a shift in the options-implied USDZAR distribution, while that there was a small shift following the 2014 election. After the 2014 election, the standard

deviation of the density (which captures uncertainty about the outlook for the USDZAR) declined, as did the skewness (capturing the implied risk that the ZAR could move in a particular direction) and kurtosis (which captures the implied risk of very large ZAR changes). After the 2014 elections, options prices implied that the market expected a lower risk of large exchange rate changes compared to the day before the election. After the 2019 election, we observe the opposite, with the FX options market pricing in slightly more uncertainty and rand risk after the election.

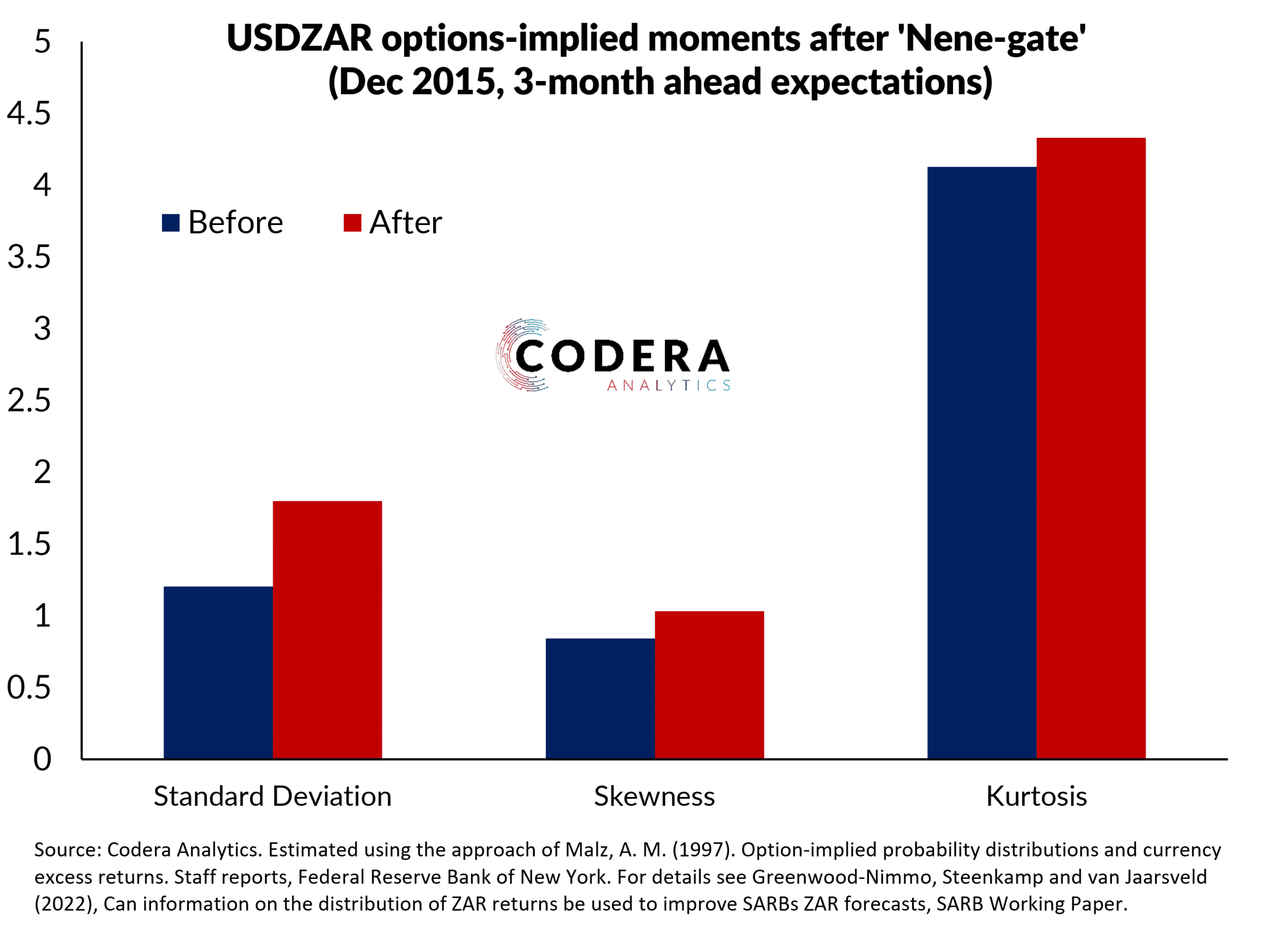

If the ANC were to loose its majority in the 2024 election, this may have a bigger impact on rand expectations than following previous elections. We know, for example, that previous political shocks have had a large impact on the market-implied ZAR outlook. Take ‘Nene-gate’ as an example. When President Zuma dismissed Finance Minister Nene on 9 December and the rand lost 5% of its value the following day, the options market immediately priced in much higher currency uncertainty and risk that the rand could depreciate further.

Footnote

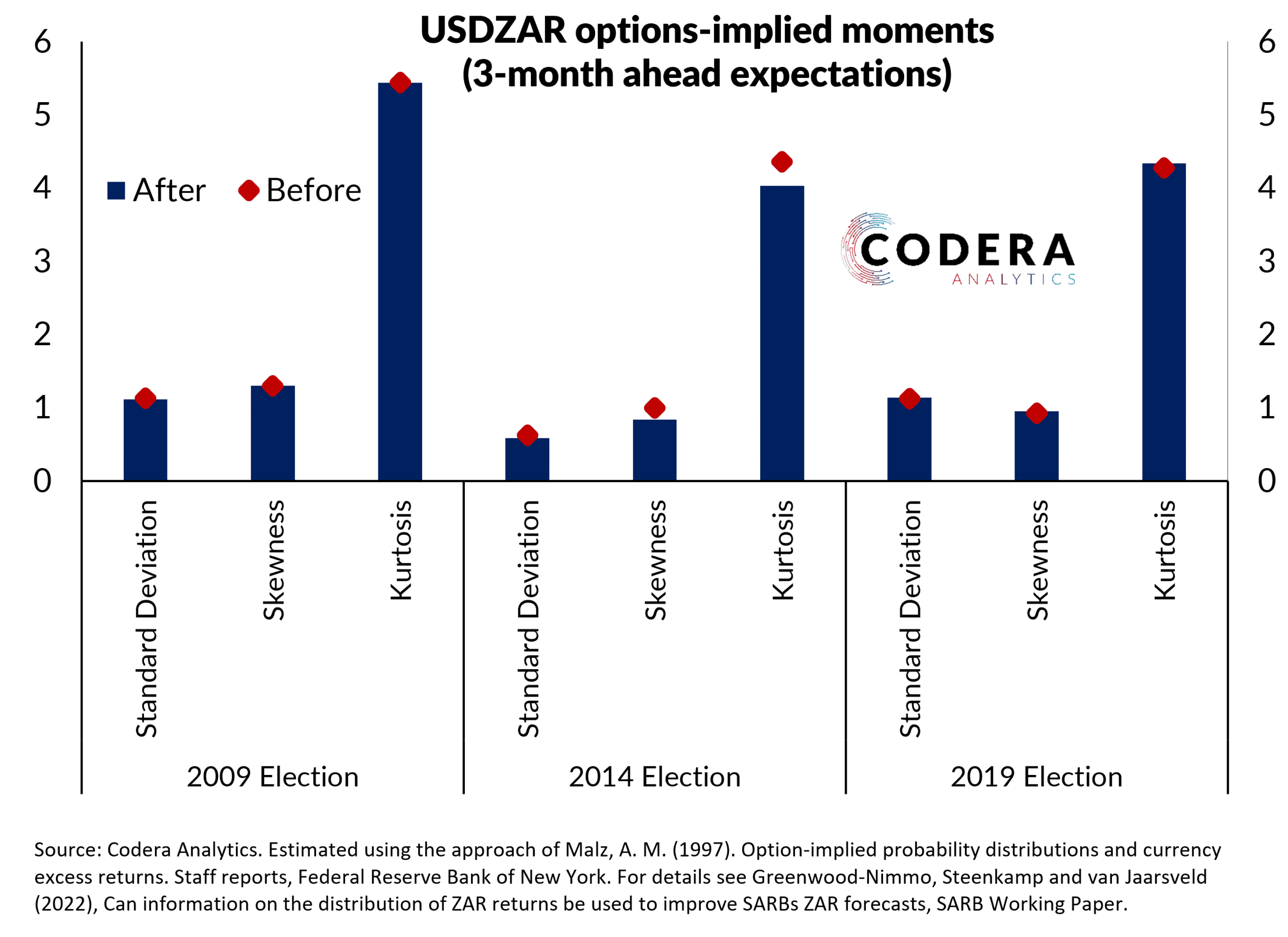

Here is what the election moments look like in levels:

For more details on the approach used read our paper, where we show that option-implied rand variance can improve forecast accuracy when predicting the USDZAR. This paper by Michelle Lewis also provides more discussion on using option pricing to gauge market expectations.