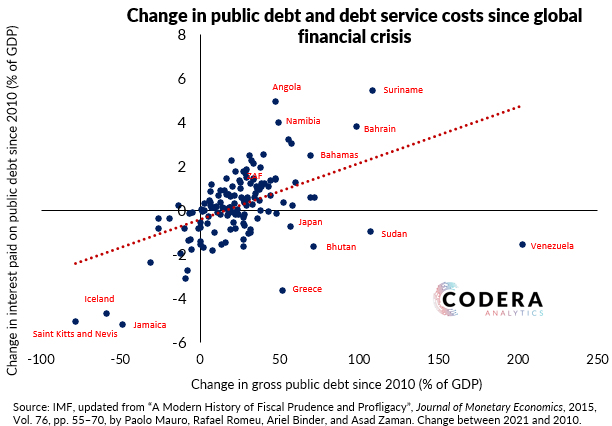

Many countries have seen large increases in their levels of public debt since the global financial crisis. Policy easing and historically low global interest rates helped to contain the impact on debt service costs. But the relationship has been strongly positive across the world overall, with higher increases in public debt being associated with larger increases in borrowing costs. South Africa’s debt ratio more than doubled, rising by almost 40% to GDP and requiring an extra 2 percentage points of GDP to service, according to data from the IMF. There are several outliers across countries, reflecting debt-relief, bail-outs or debt restructuring for economies such as Sudan, Greece or Venezuela.