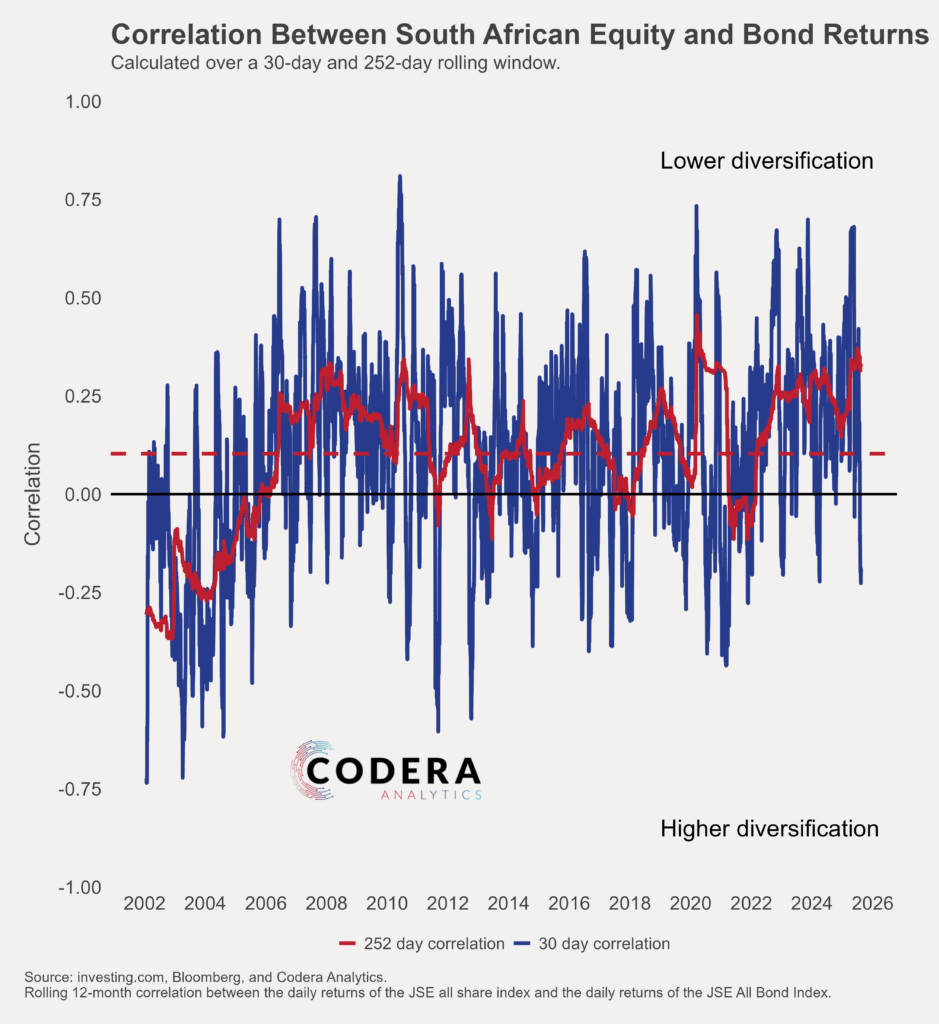

In 2025, the correlation between equities and bonds remains a central theme for investors, as shifting inflation expectations and interest rate paths drive asset class co-movements. In the US, falling inflation restored the traditional low/negative correlation in late 2024, with bonds once again serving as a hedge against equity drawdowns. By contrast, in South Africa, today’s post by Oliver Guest shows that persistent fiscal risk and currency volatility keep bond–equity correlations more unstable, limiting diversification benefits for local investors. In future posts, we will compare correlations over a range of horizons across markets.