South Africa’s sovereign credit default swap (CDS) spread, which measures market perception of our government’s credit risk in

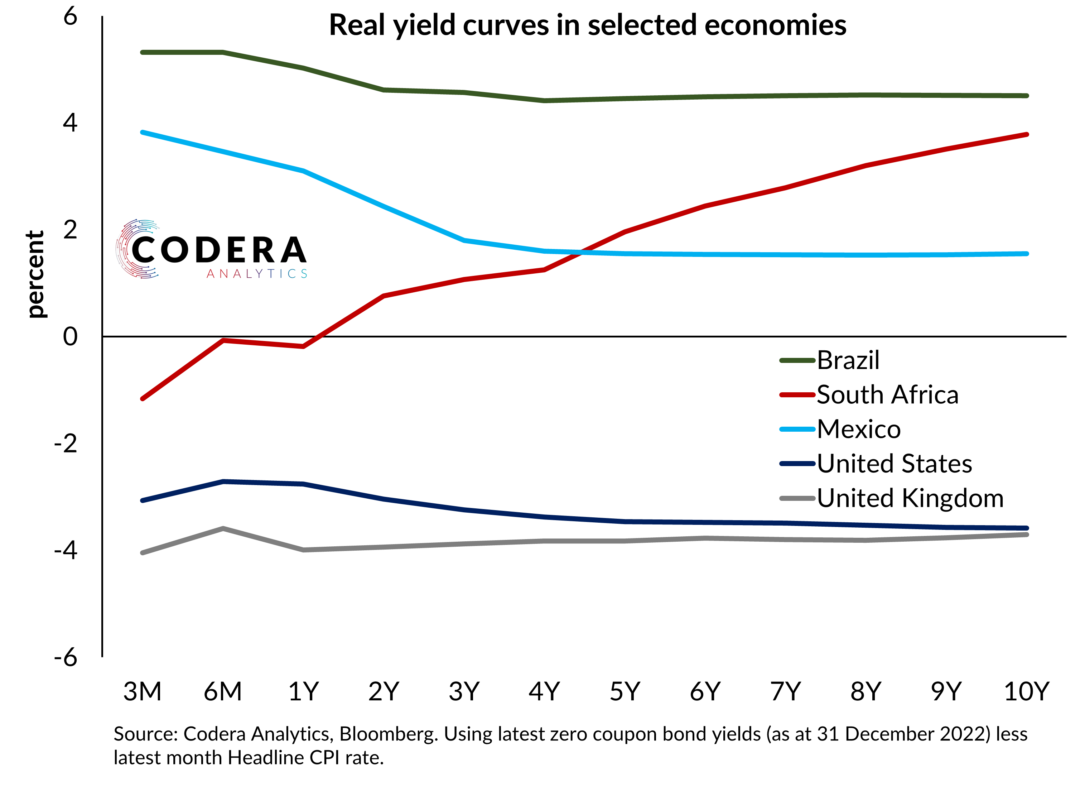

US dollar terms, has been meaningfully higher since the global financial crisis (GFC) of 2008 and spiked again during the political uncertainty surrounding the removal of the Finance Minister in late 2015 and the onset of the COVID-19 pandemic. Long bond rates have also been higher since the GFC, particularly when expressed relative to the policy rate to control for the monetary policy cycle. The implication of a steeper yield curve has been higher borrowing costs for the government.