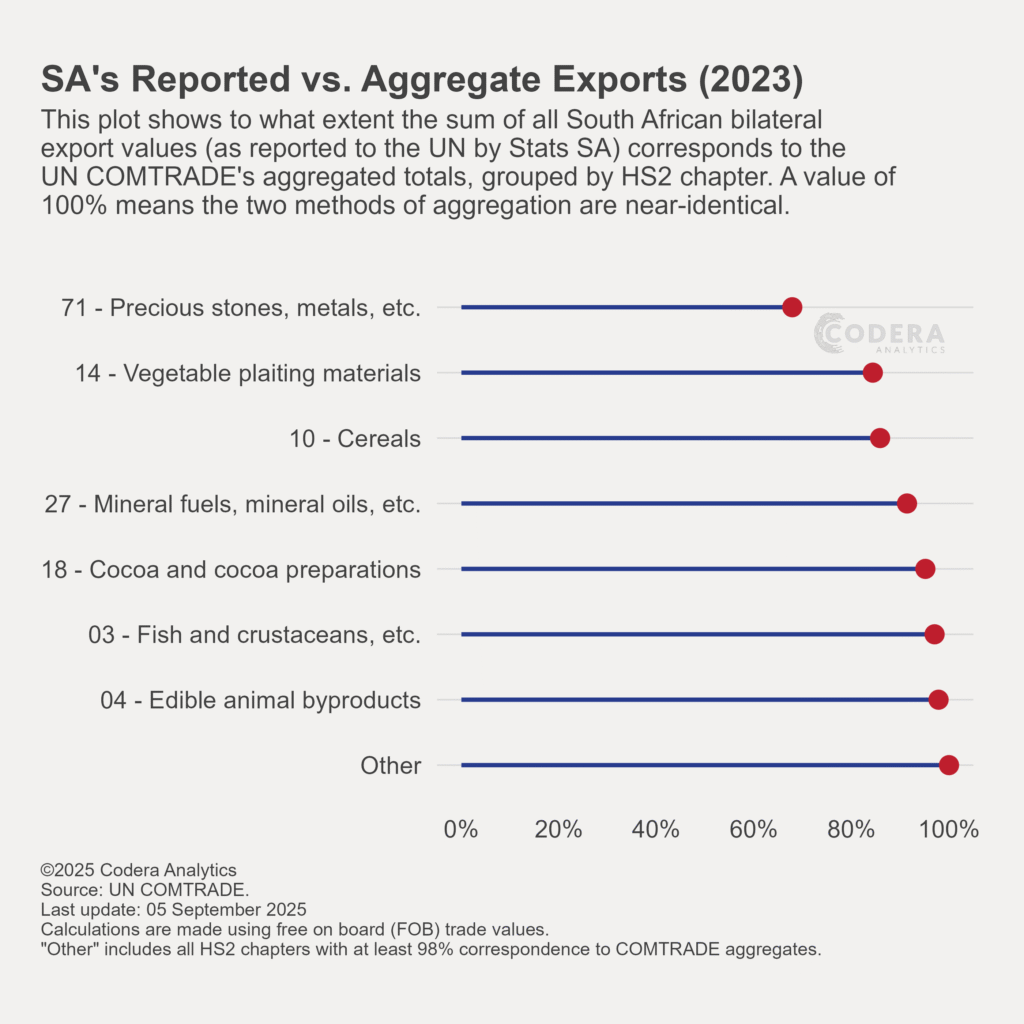

Many economists report trade data without critically assessing how differences in reporting standards affect estimates. Today’s post by Jacques Quass De Vos shows how much of South Africa’s exports (as reported to the UN COMTRADE by Stats SA) corresponds to their COMTRADE-aggregated totals, grouped by HS2 chapter. While most chapters have a near 1:1 correspondence, some display great variation.

The significant discrepancy for HS71—SA’s largest export category, accounting for raw or semi-manufactured platinum and other precious metals/stones—is not necessarily a data error, but rather reflects methodological challenges when working with international trade statistics.

The reasons for these reported differences are complex and multifaceted. Key factors likely include: (1) the potential use of nowcast estimates in COMTRADE’s aggregate figures pending the receipt of complete data from all countries; (2) complex global supply chains that obscure the true country of origin for finished goods; (3) the inherent difficulty in the valuation of high-value precious metals and stones; (4) the mixing of FOB (free on board) and CIF (cost, insurance, freight) valuations in final aggregates; and (5) the possible suppression of select bilateral trade data for confidentiality reasons.

These factors, among others, make for an inherently murky data environment. Therefore, this plot is a reminder for caution when working with large-scale aggregates and to understand the underlying data before drawing any conclusions. For SA, for example, SA refines a lot of gold on behalf of other exporters, and different countries use different reporting standards that can obscure trade flows. The same is true for military exports for SA: SA defense force figures show a massive spike in certain exports in 2023, while the COMTRADE data show no weapon sales for 2023. Mirror data show that 21 countries in Africa alone imported arms from/via SA in 2023. The challenge also exists for investment data, see this earlier post on mirror data for FDI across the world. As with all big data analysis, the principle of caveat emptor, or “buyer beware,” applies with trade and investment data.