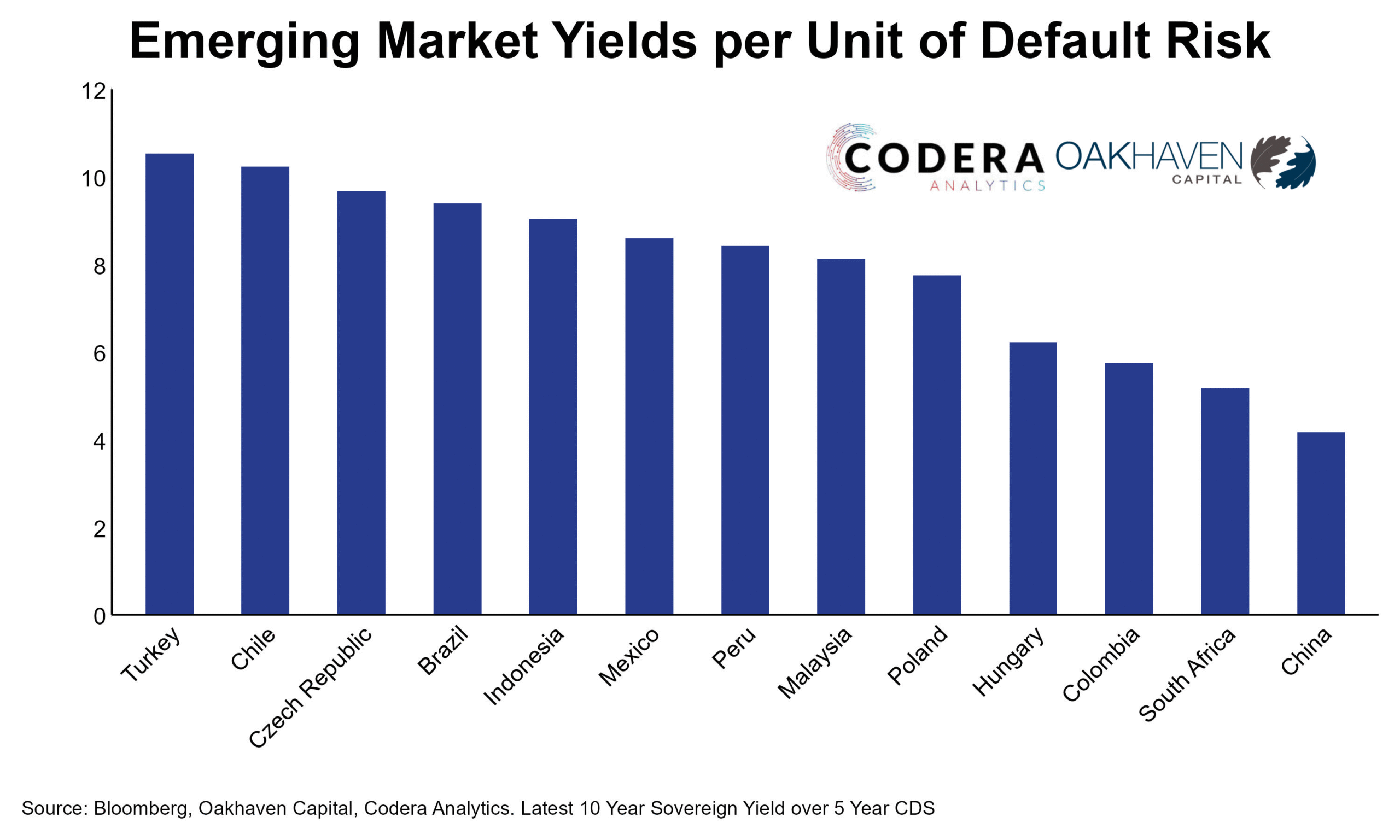

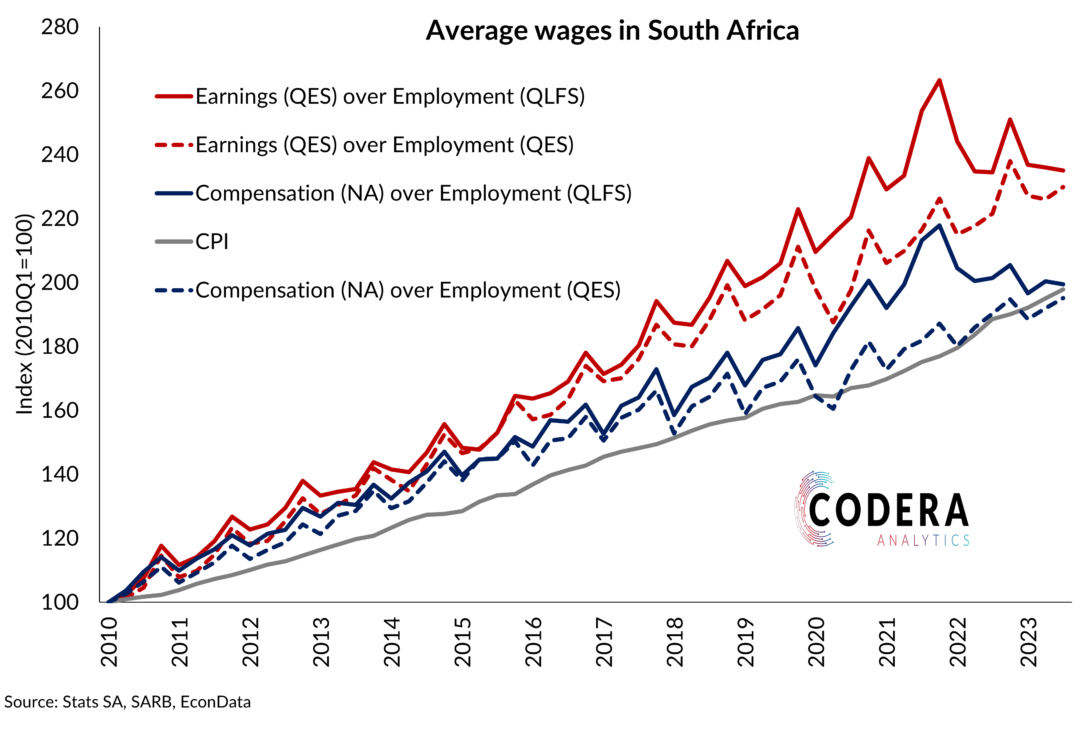

In today’s post by Takudzwa Mutetwa we show that South Africa stands out for high sovereign long bond yields, reflecting fiscal and political risk premia, while the rand’s volatility ranks near the top of the EM spectrum. This combination of high carry but unstable currency dynamics makes South Africa a persistent headache for risk managers. As we showed in earlier research, the average level of the rand variance risk premium is relatively high by international standards as it is strongly affected by global FX liquidity and that the rand acts as a ‘bellwether’ emerging market currency. As a result, we have argued that one possible explanation for South Africa’s steep sovereign yield curve is that meaningful exchange rate depreciation risk is embedded in our long-term interest rates. If South Africa can successfully transition to a lower inflation target, this may help to lower the inflation risk premium priced into South African government debt (as we argue here).