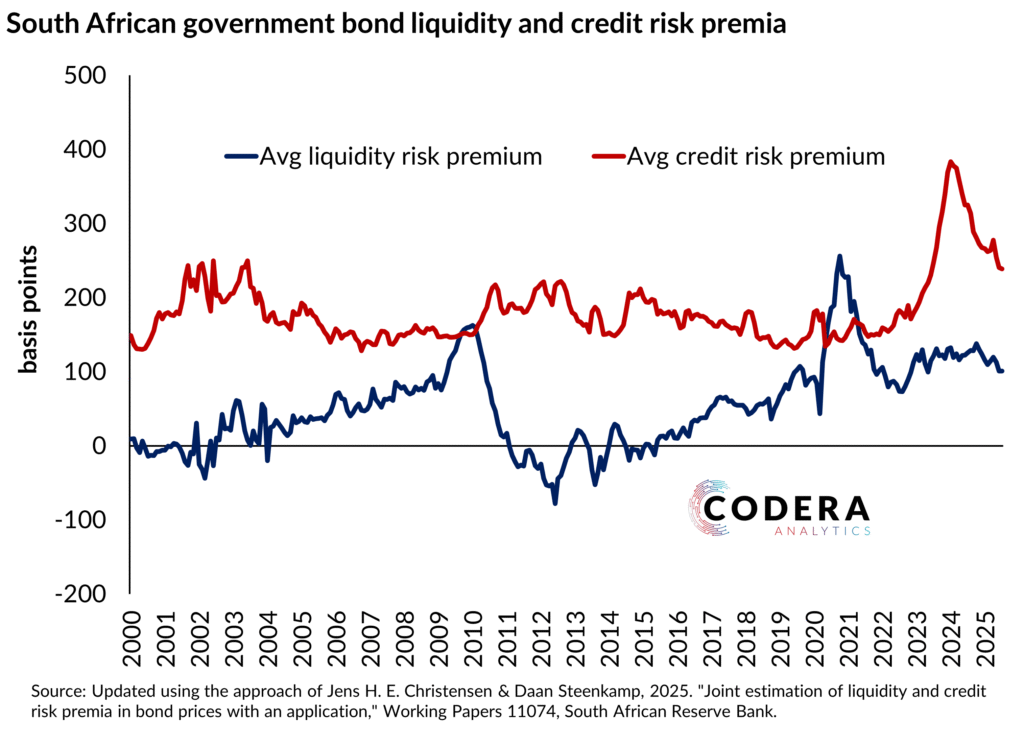

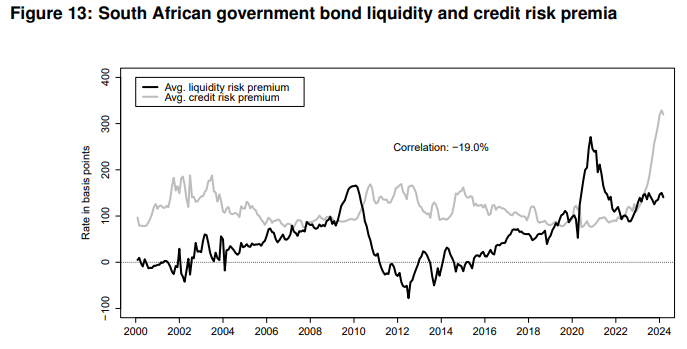

In today’s post, we update estimates from a recent South African Reserve Bank working paper of South African government bond market liquidity and credit risk premia. We show that increases in bond market liquidity and government credit risk premia have contributed to higher South African sovereign borrowing costs over the last decade. These premia remain elevated by historical standards.