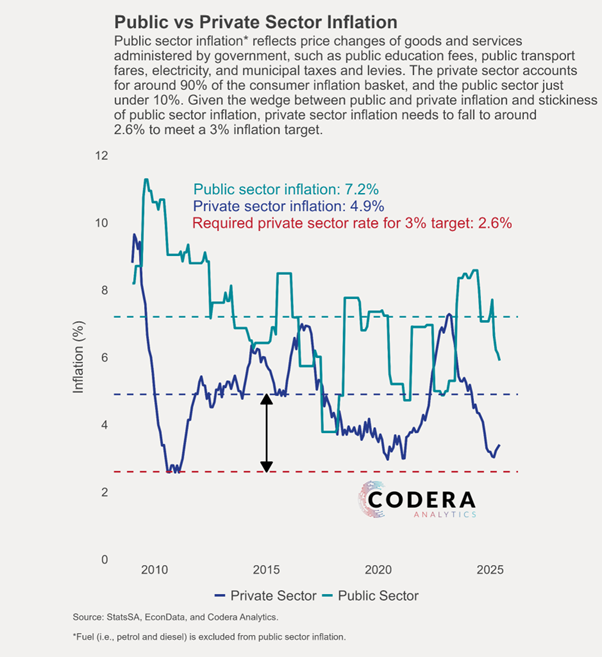

As we argue in our paper on gaps in the inflation targeting debate, successfully pivoting to a 3% inflation target necessitates alignment from government-set components, otherwise the SARB will need to keep monetary policy tight to reduce private sector inflation to below their new preferred level. As we expect public sector inflation to remain elevated, the SARB will to lower private sector inflation to levels we have not seen in South Africa. Today’s post by Oliver Guest shows that public sector inflation has averaged 7.2% since 2009, compared to 4.9% for private sector inflation (excluding fuel inflation). Given the wedge between public and private inflation and our expectation that government inflation will remain elevated, private sector inflation would need to fall to around half of its average level since 2009 (just under 2.6%). This is line with RMB Morgan Stanley’s estimate from Andrea Masia using a slightly different calculation.