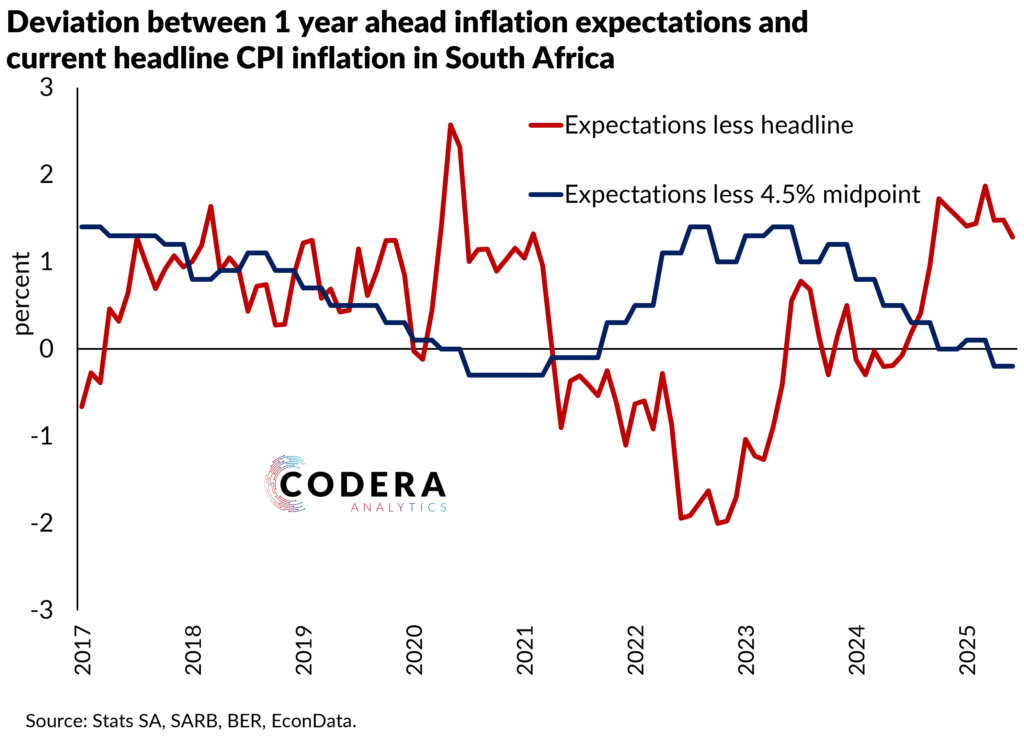

The gap between inflation expectations and headline CPI is a useful indicator of monetary policy credibility. With the SARB Monetary Policy Committee (MPC) now aiming for a lower target of 3%, the persistence of elevated expectations relative to actual inflation could signal either lingering skepticism in markets or structural stickiness in price formation. History offers a cautionary tale: when the midpoint target of 4.5% was introduced in 2017, it took around four years (and helped by an unprecedent pandemic shock) for expectations to converge temporarily, reflecting the slow-moving nature of entrenched inflation perceptions. The post-pandemic cost of living crisis saw inflation expectations unanchor once again, and only again converge on the target in late 2024 as the inflation cycle turned.

The current deviation between expectations and current CPI must therefore be viewed as a gauge of how quickly households, businesses, and markets are internalising the new policy anchor. We have demonstrated in our policy paper on the gaps in the inflation targeting debate that inflation expectations are backward-looking in South Africa – meaning that inflation expectations will only decline sustainably if inflation remains at the MPC’s new preferred level for an extended period.