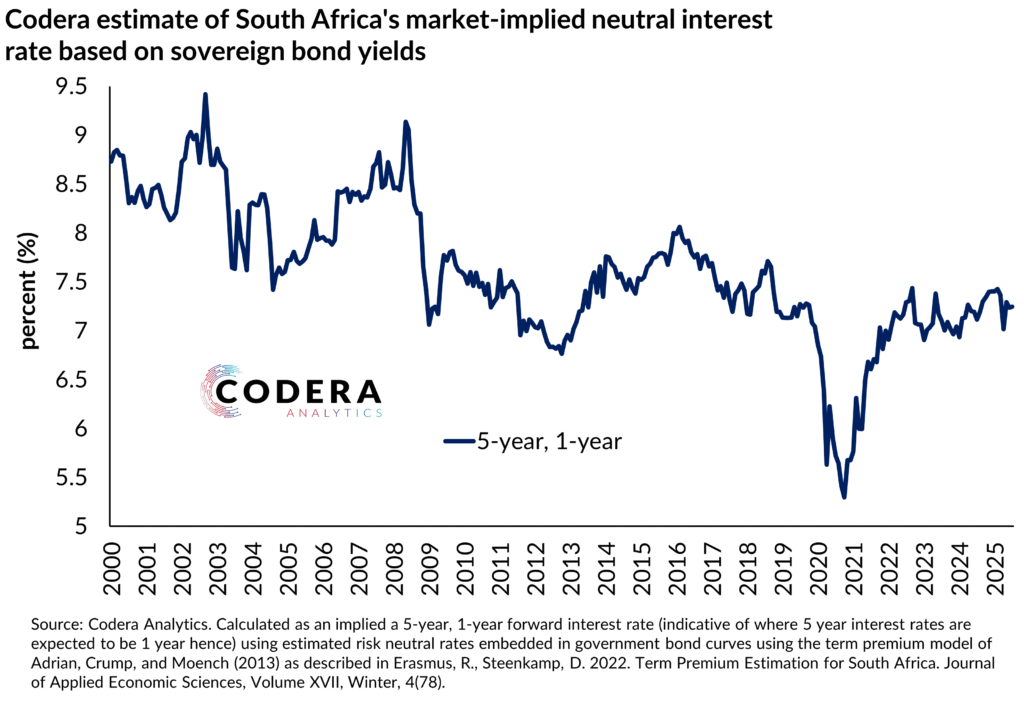

After last week’s SARB MPC announcement of a 3% interpretation of its inflation target, our model still implies that the market-implied neutral rate is around 7.25%. The SARB’s current neutral estimate is 2.8% real (5.8% nominal assuming a 3% inflation target). Our estimate implies that monetary policy is currently not as tight as the MPC argues, as the policy rate is 7%. Instead, bond market pricing suggests that the current policy stance is broadly consistent with a neutral stance. We will continue to update these estimates to report whether the market will be convinced that a lower inflation target is credible and can be achieved without higher interest rates.