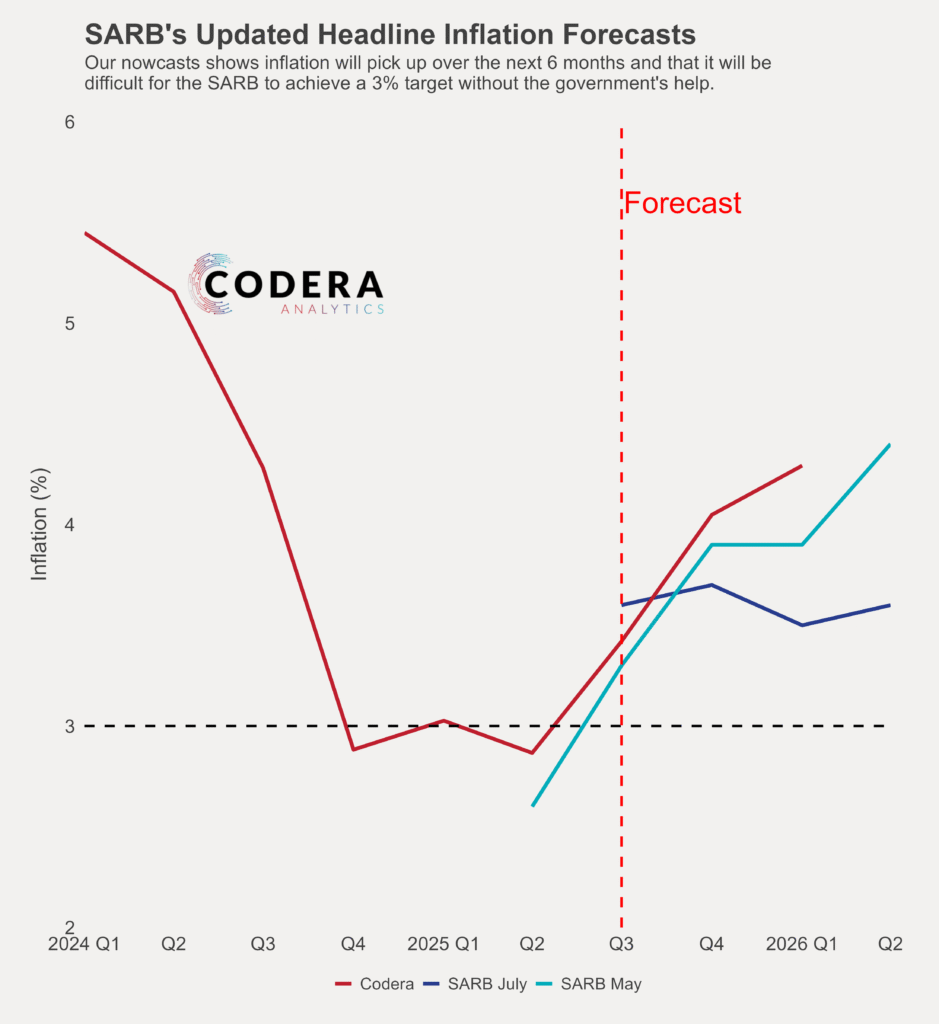

The SARB published updated forecasts yesterday, with the Monetary Policy Committee signaling that it would now prefer a lower 3% interpretation of their inflation target. The inflation target has not been formally changed – that requires agreement with the Treasury. The SARB also lowered its inflation trajectory, in large part, on an assumption that inflation expectations and price setting will rapidly adjust downwards. Today’s post by Oliver Guest shows that our view is still that inflation will pick up over the next 6 months and that it will be difficult for the SARB to achieve a 3% target without the government’s help. The SARB cut by 25 basis points and now predicts that it can cut interest rates by another 100 basis points by the end of next year.

As we have argued before, it is unlikely that SARB will be able to lower the policy rate further without complementary government policies and buy-in from organs of the state and unions. If the exchange rate continues to depreciate as we predict, and government-related inflation continue to average well above the current official inflation target, this decision could cost the private sector billions and erode the SARB’s hard-won credibility. This is because a lower target will require higher interest rates over the short term than overwise, and without government cooperation, will mainly increase the cost of capital.

EconData provides historical vintages of SARB, Treasury and IMF forecasts to make it easy to compare forecasts and analyse forecast errors and revisions. Clients can subscribe to nowcasts, data service and other interactive analytical products. Contact us for a demo.