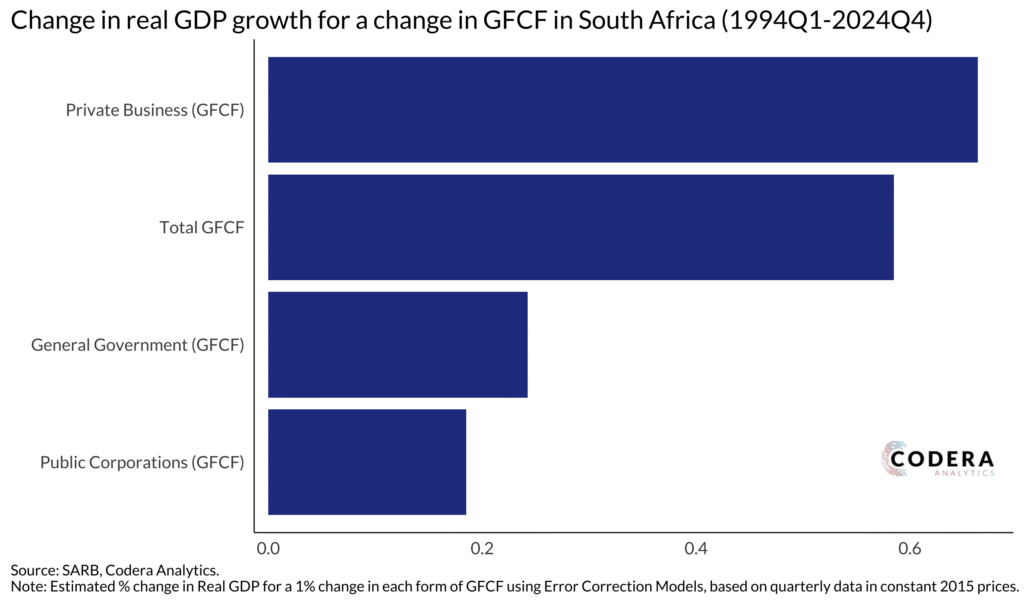

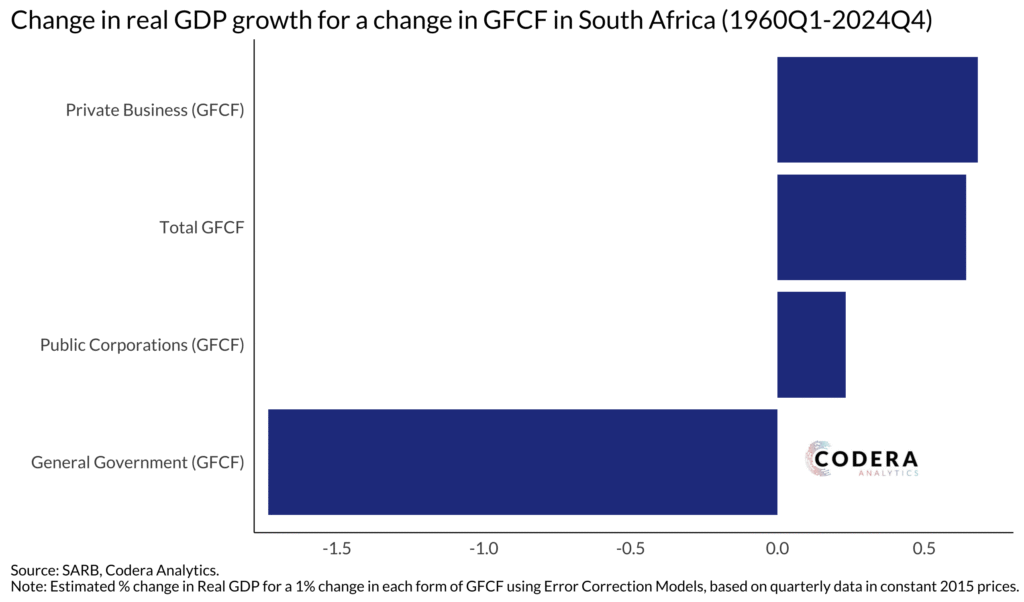

Investment multipliers provide a measure of how much GDP increases for every rand of investment. In today’s post by Gabriella Neilon provides simple estimates of investment multipliers for different forms of investment in South Africa. We use error correction models and measure the multiplier as the percentage change in output from a one percent change in investment. The estimates show that before 2010, the aggregate investment multiplier was larger than 1-for-1. Since then, South Africa’s investment rate has fallen towards pre-democracy lows driven by lower private investment and a dramatic decline in government investment.

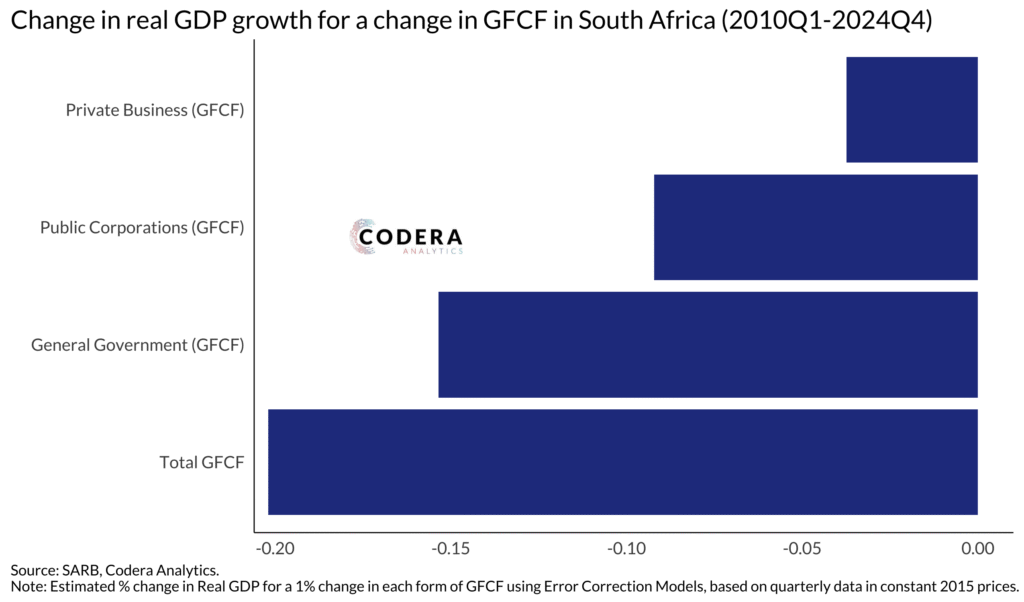

Estimated investment multipliers have all been negative since 2010. While this may seem surprising, it reflects the decline in investment and trend growth over this period. South Africa’s productivity has declined dramatically over this period as well, and state owned corporation output has declined – think of falling electricity available for distribution despite investment in new power stations. As we have shown previously, several industries in South Africa have experienced a decline in their capital stock over recent decades as a consequence of low investment and high depreciation. This suggests that achieving faster economic growth in South Africa would not simply require increased investment, but also reforms that address the factors responsible for government inefficiency and falling productivity.

It is important to note that different estimation approaches provide different estimates of investment multipliers. See our earlier post for alternative estimates. These estimates also do not control for industry or macroeconomic factors that may have affected investment elasticities.