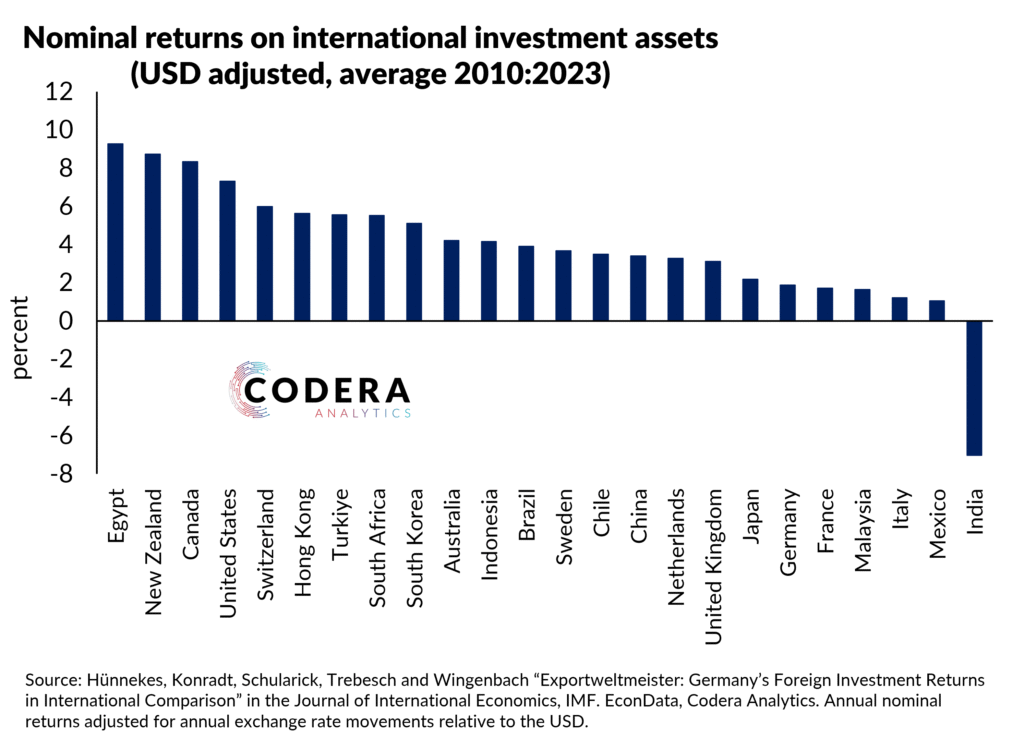

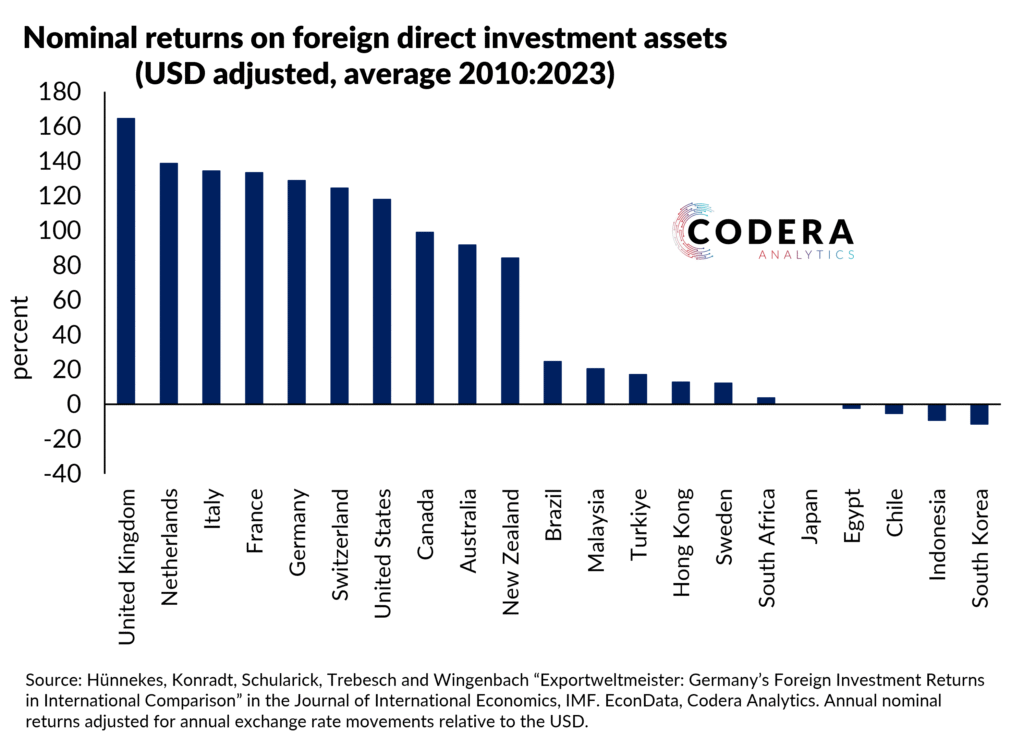

A new dataset of foreign returns of nations provides long term estimates of real local currency returns to South Africa’s international investment portfolio (IIP). Today’s post compares nominal return on total international investment portfolio assets denominated in local currency in percent and adjusting for changes in the exchange rate. For advanced economies, returns to foreign direct investment assets has been dramatically higher than emerging markets since 2010.

As we have shown in earlier posts, the yield on South Africa’s foreign liabilities has tended to exceed that on its foreign assets by a large margin, helping to keep South Africa’s net international investment position in positive territory, despite persistent twin deficits (fiscal and current account deficits).

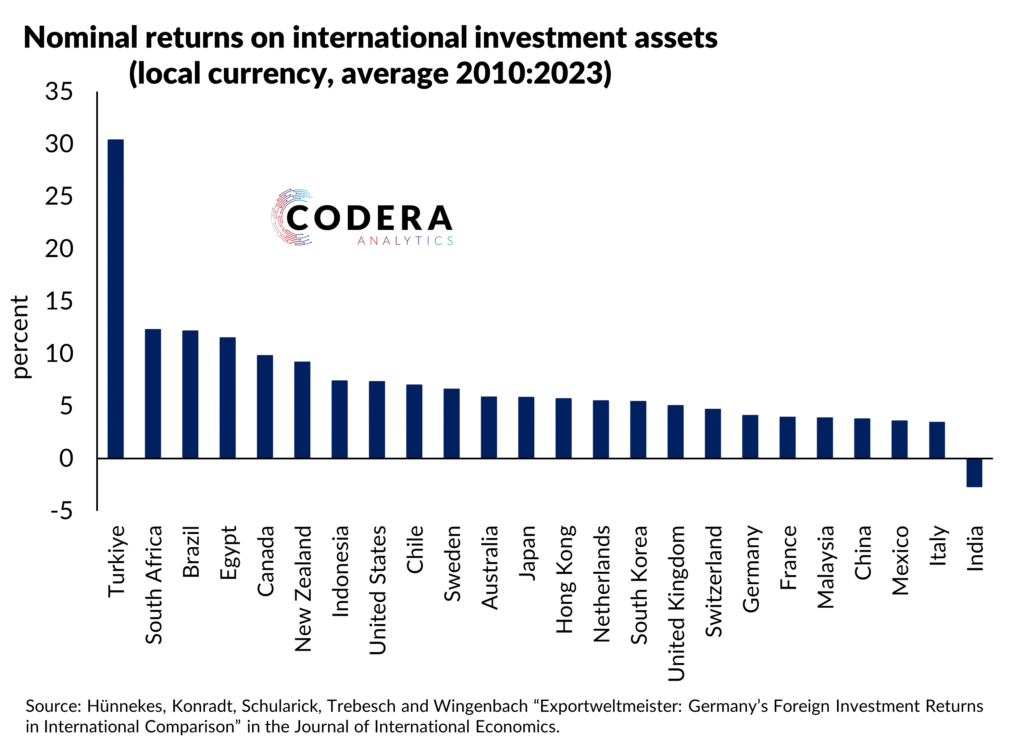

The chart below shows the estimates prior to exchange rate adjustment: