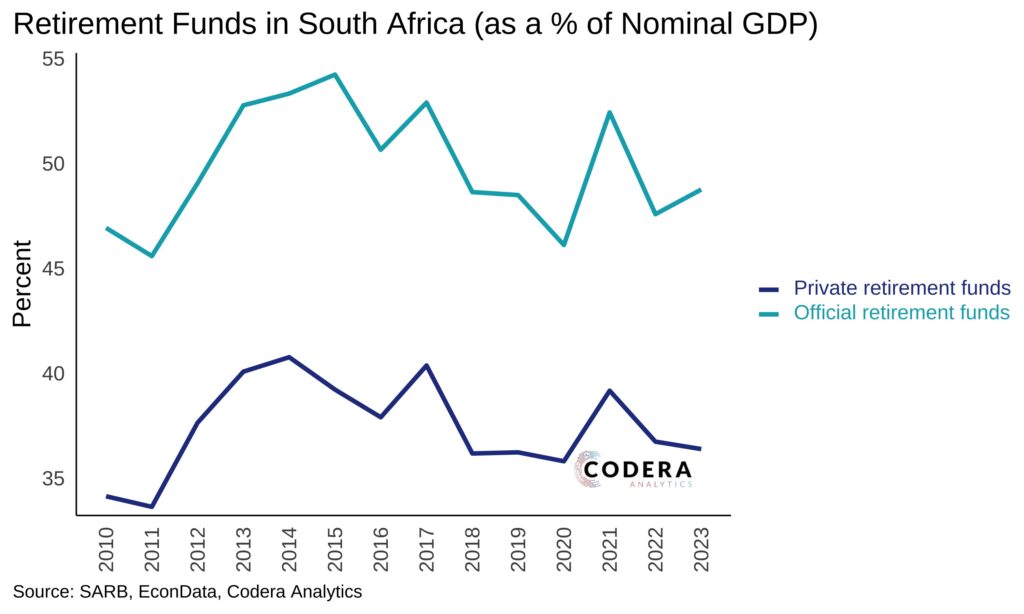

Today’s post by Gabriella Neilon compares ratios of private and official pension fund assets under management to GDP in South Africa. South Africa’s ratio of overall pension fund assets to GDP is high by global standards, reflecting, for example the large size of the Government Employees Pension Fund (which is a fully funded, defined benefit scheme covering civil servants who contribute 7.5% of earnings, with a government contribution of 16%) and large proportion of the employees participating in voluntary defined contribution pension funds. In earlier posts, we assessed pension fund performance in South Africa and costs.