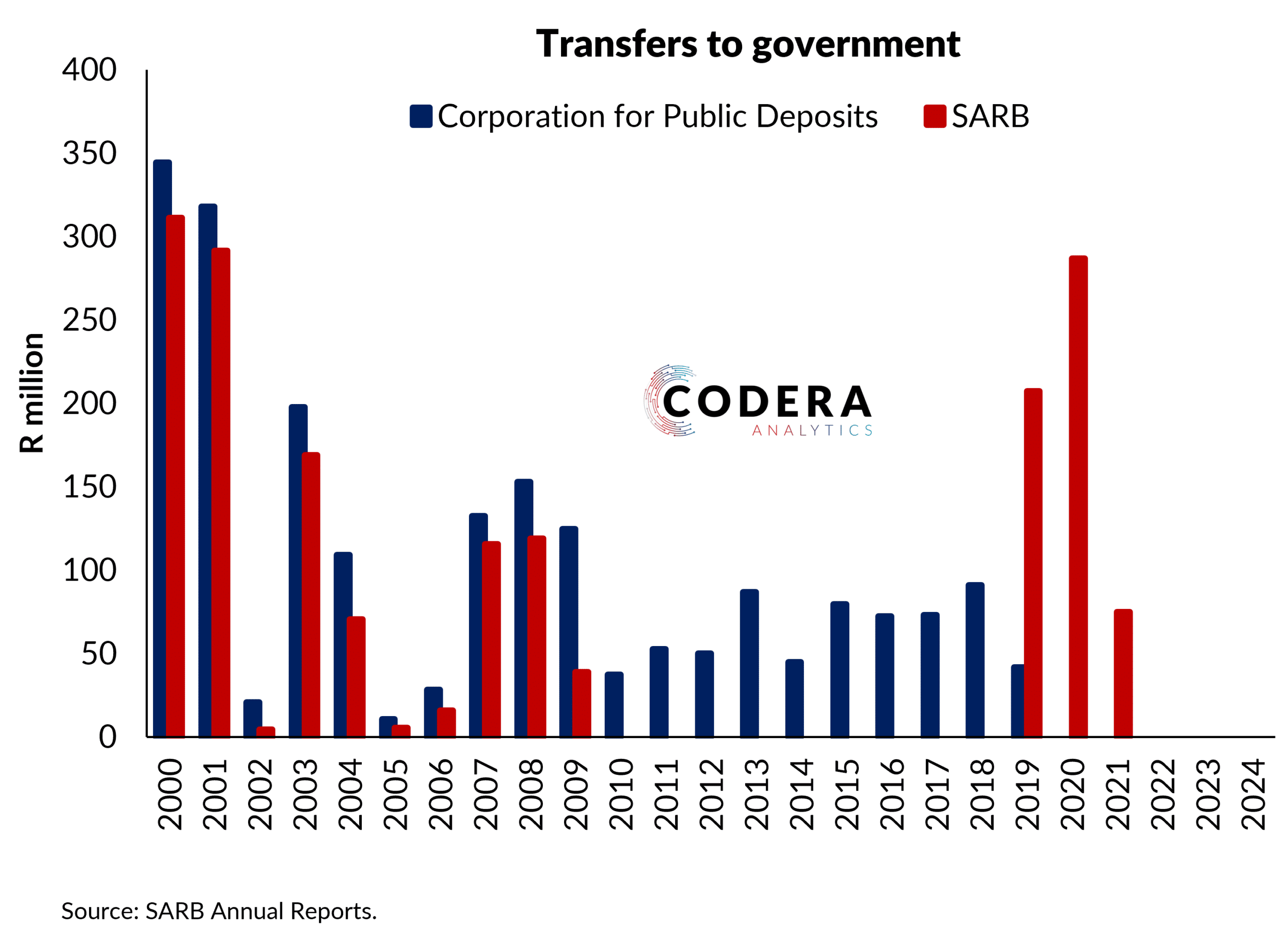

The SARB Act stipulates that 9/10ths of the SARB’s surplus after provisions and dividends must be transferred to government. The Corporations of Public Deposits (CPD) Act stipulates that the SARB Group that the balance of net profits after transfers to reserves and payment of dividends must be paid to government. The SARB did not transfer any income to the government between 2010 and 2019 and and has not transferred any income since 2021. Over the next three years, SARB and National Treasury have agreed to settle R250 billion of the Gold and Foreign Exchange Contingency Reserve Account (GFECRA), with the National treasury transferring R100 billion to the SARB in the 2024/25 to promote the policy solvency of the SARB. The SARB group has not paid distributions required by the CPD Act since 2019, in part as a result of impairment losses suffered from its holdings of African Bank.