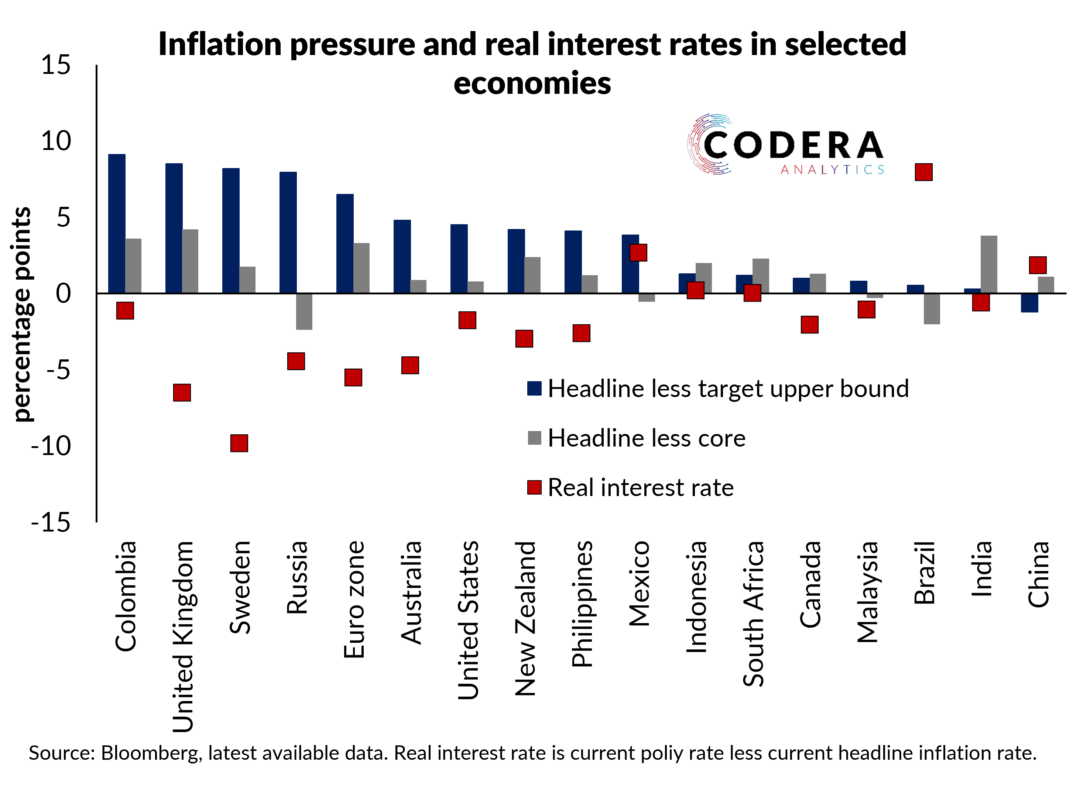

Our bond market-implied estimate of the neutral interest rate in South Africa suggests that another 25 basis points of tightening is needed for monetary policy to shift to a neutral policy stance.

Footnote

The chart uses current inflation to deflate the estimated bond market expected nominal neutral rate since existing bond market-based measures of inflation expectations contain distortionary liquidity and credit premia.

SARB assumes a steady state (i.e. long-term once inflation is back to mid-point of 4.5%) real neutral rate of 2.5% in its forecasting model.