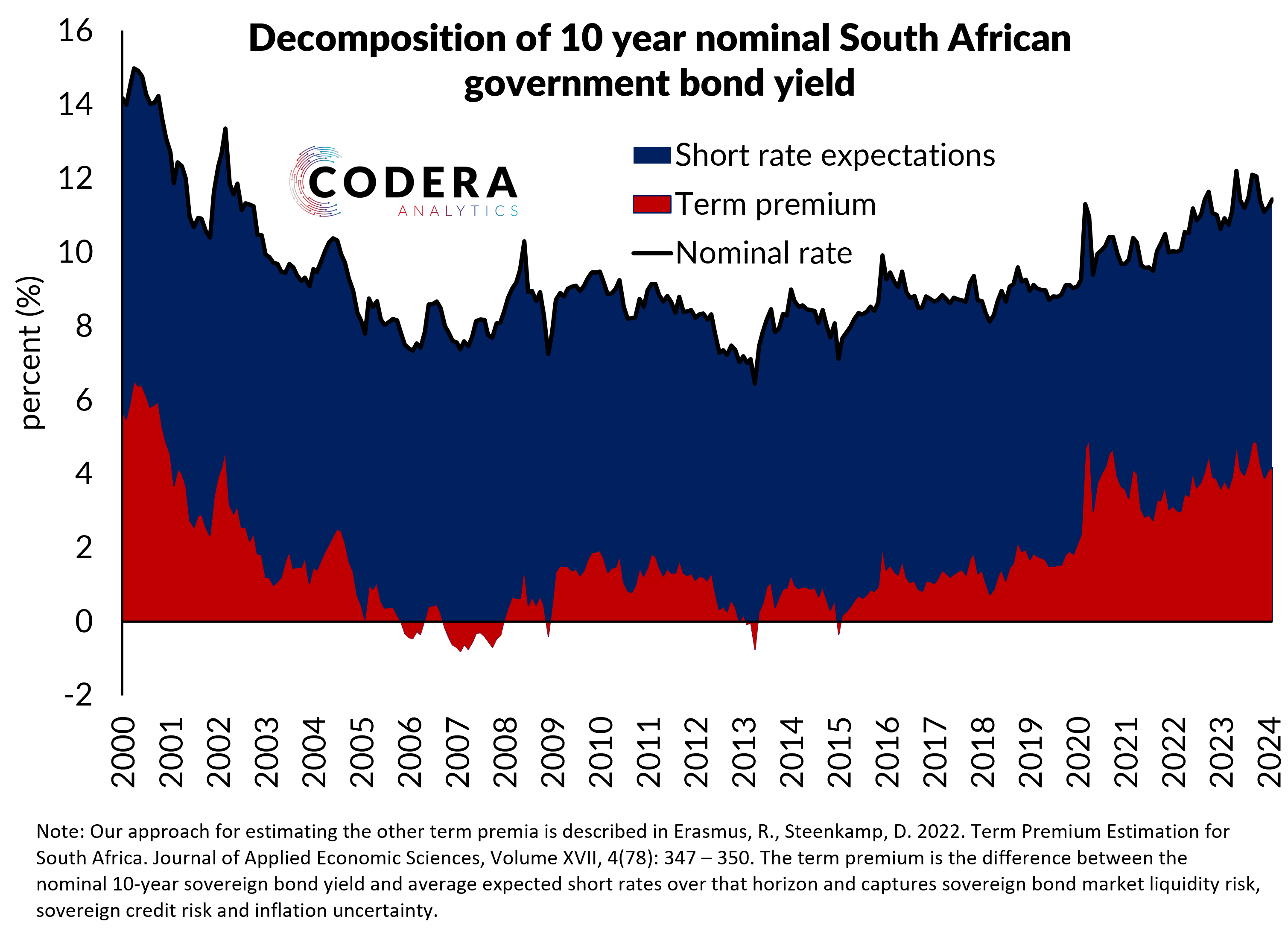

Our term premium model shows that the increase in nominal government bond yield in South Africa since its trough in 2013 reflected a higher term premium and not a meaningful change in expectations around the stance of monetary policy. This also implies that the neutral rate of the economy (reflecting where short-term interest rates are expected to settle in coming years once the effects of shocks have faded) has not declined meaningfully over this period as it did in many major markets.