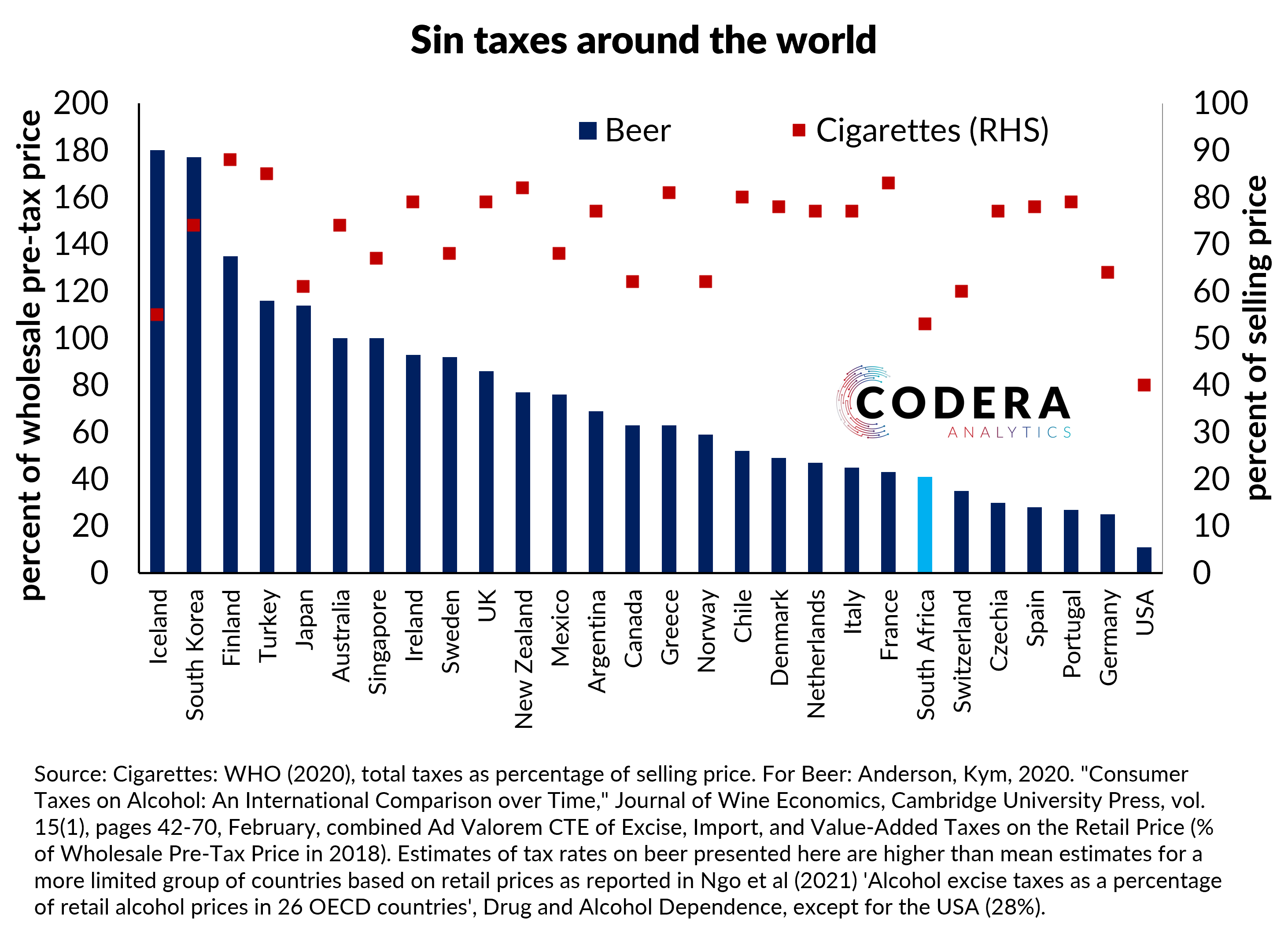

It is very difficult to get comparable estimates of the ‘sin taxes’ imposed in different countries as the types of taxes imposed differ and the selling prices of products change over time. The total taxes imposed on beer, for example, differs dramatically across countries. According to Anderson (2020), Iceland and South Korea imposed taxes amounting to almost double the pre-tax wholesale price of beer in 2018, compared to 41 percent in South Africa. In the case of cigarettes, the WHO estimates suggest that South Africa imposed total taxes of 53 percent of retail prices in 2020, compared to a median total tax rate in the sample of countries on the chart of 77 percent.