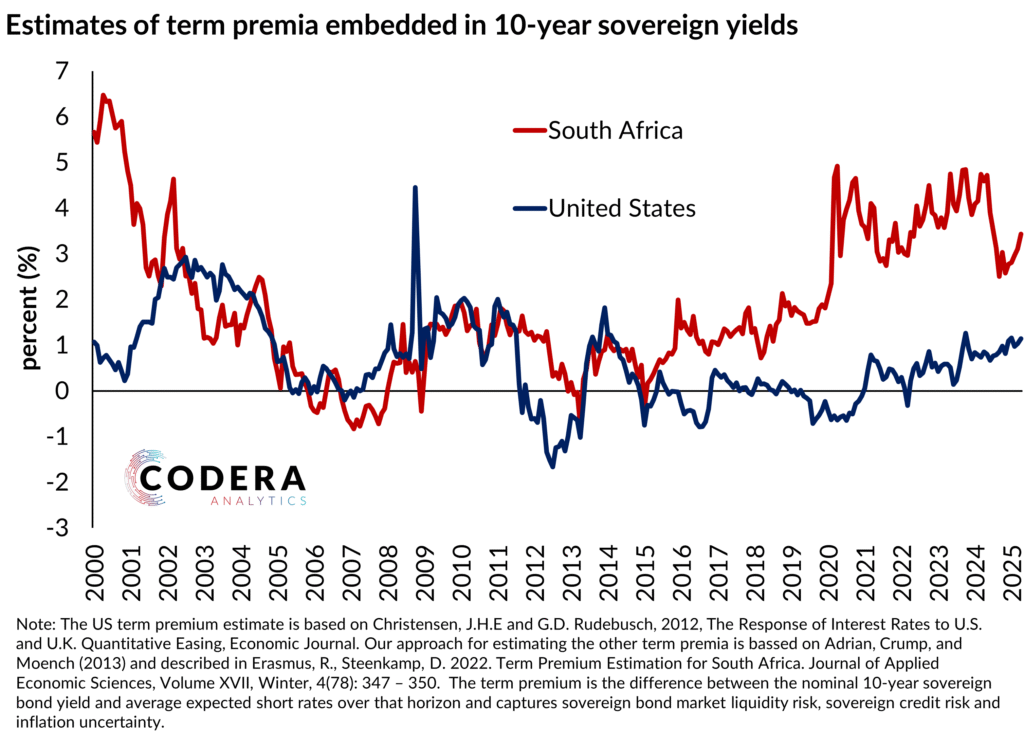

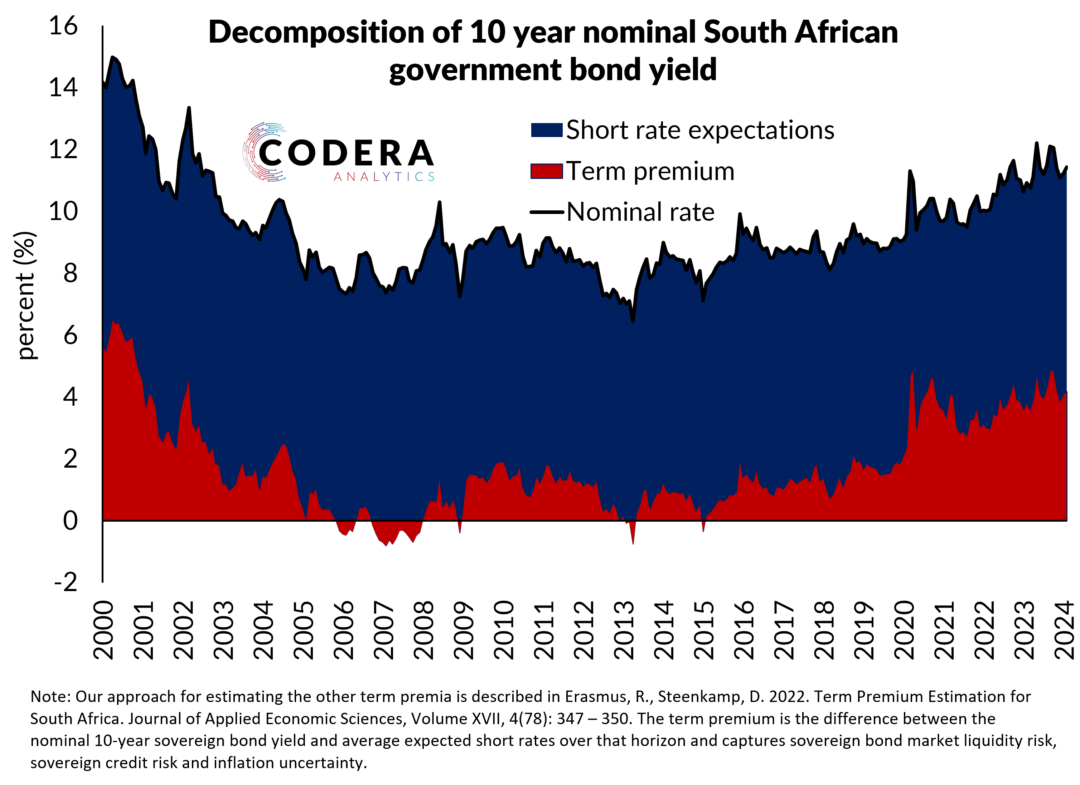

Long-term interest rates are primarily driven by two components: expectations of future short-term interest rates and the term premium. The term premium represents the compensation investors demand for committing to a long-term investment instead of rolling over short-term instruments. It reflects uncertainty about future determinants of nominal interest rates—such as inflation, credit risk, and liquidity conditions—which tend to increase with maturity. This rising uncertainty at longer horizons is one reason why the yield curve typically slopes upward. Our model implies that South Africa’s term premium is higher than in many other emerging markets. In 2025, the US term premium has been rising as investors unwound risk positions and shifted away from dollar-denominated assets. South Africa has seen a bigger rise in our term premium.