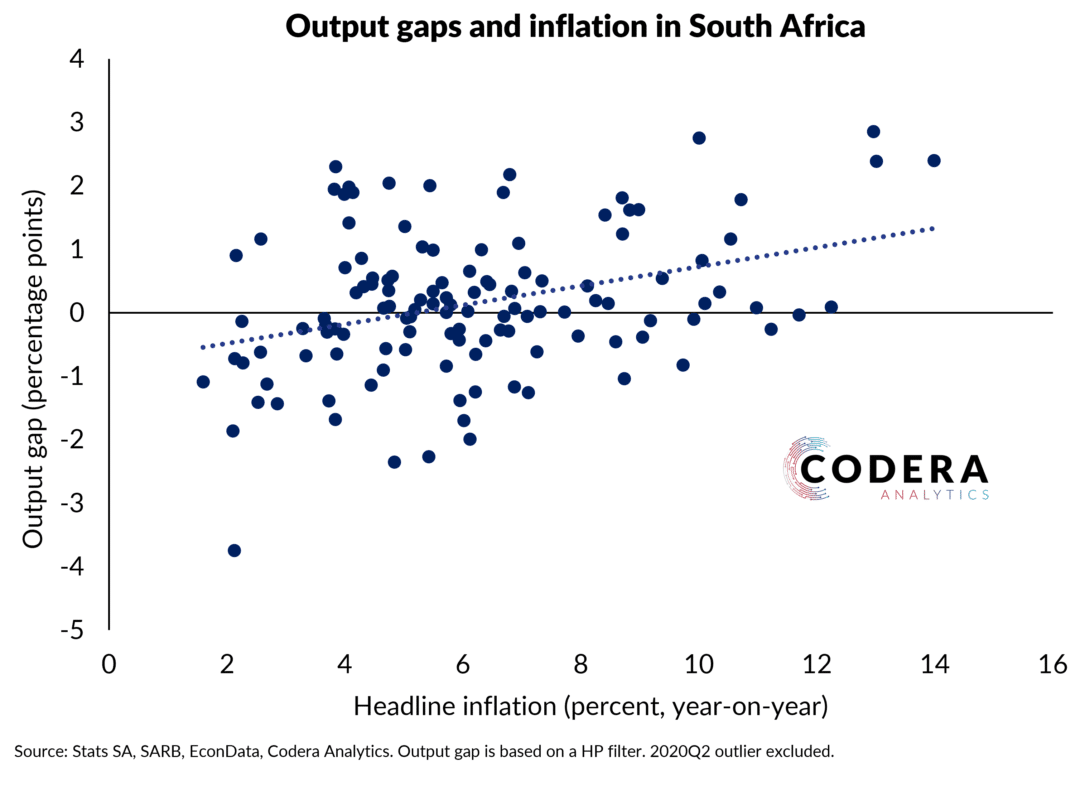

In a recent speech, the Reserve Bank Governor suggested that disinflation costs in South Africa have generally been low on account of SARB’s credibility and quality of communication. Such a view is built on the idea that the ‘Philips curve’ is relatively flat in South Africa and inflation expectations are well anchored.

Central banks estimate the relationship between economic slack and inflation (‘the Phillips curve’) to asses the trade-off between reducing inflation and potential loss of employment and output. Estimates from the IMF suggest that the slope of the Phillips curve has steepened in South Africa post-pandemic, with a decrease in economic slack being associated with a larger increase in inflation, for example. The IMF estimates are consistent with our assessment of the implications of capacity pressure for inflation and interest rates in this pre-pandemic paper and our analysis that suggests that inflation expectations are less well anchored in South Africa than in other countries (see here and here). It also implies that the costs of shifting to a lower inflation target might be higher than implied in the Governor’s speech.