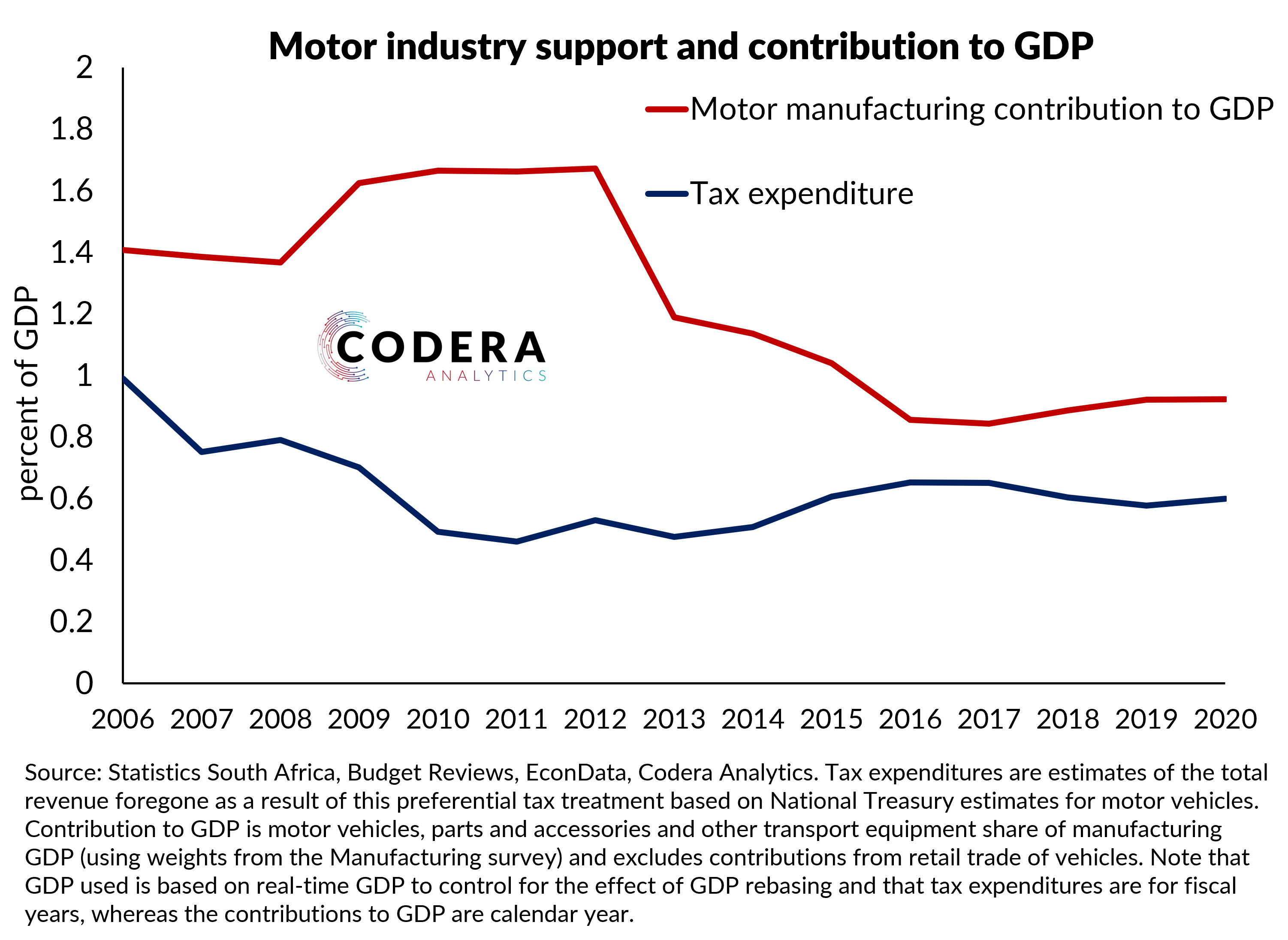

Preferential tax treatment of some products or activities imply forgone government revenue. One of the largest recipients of this type of support is the automotive industry, which cost our fiscus R34bn in foregone tax in 2020. The vehicle manufacturing industry itself is relatively small, contributing around 1% to our GDP directly, though some have argued that the automotive industry’s total contribution is closer to 7% if retail trade and its indirect effects on other industries are included.