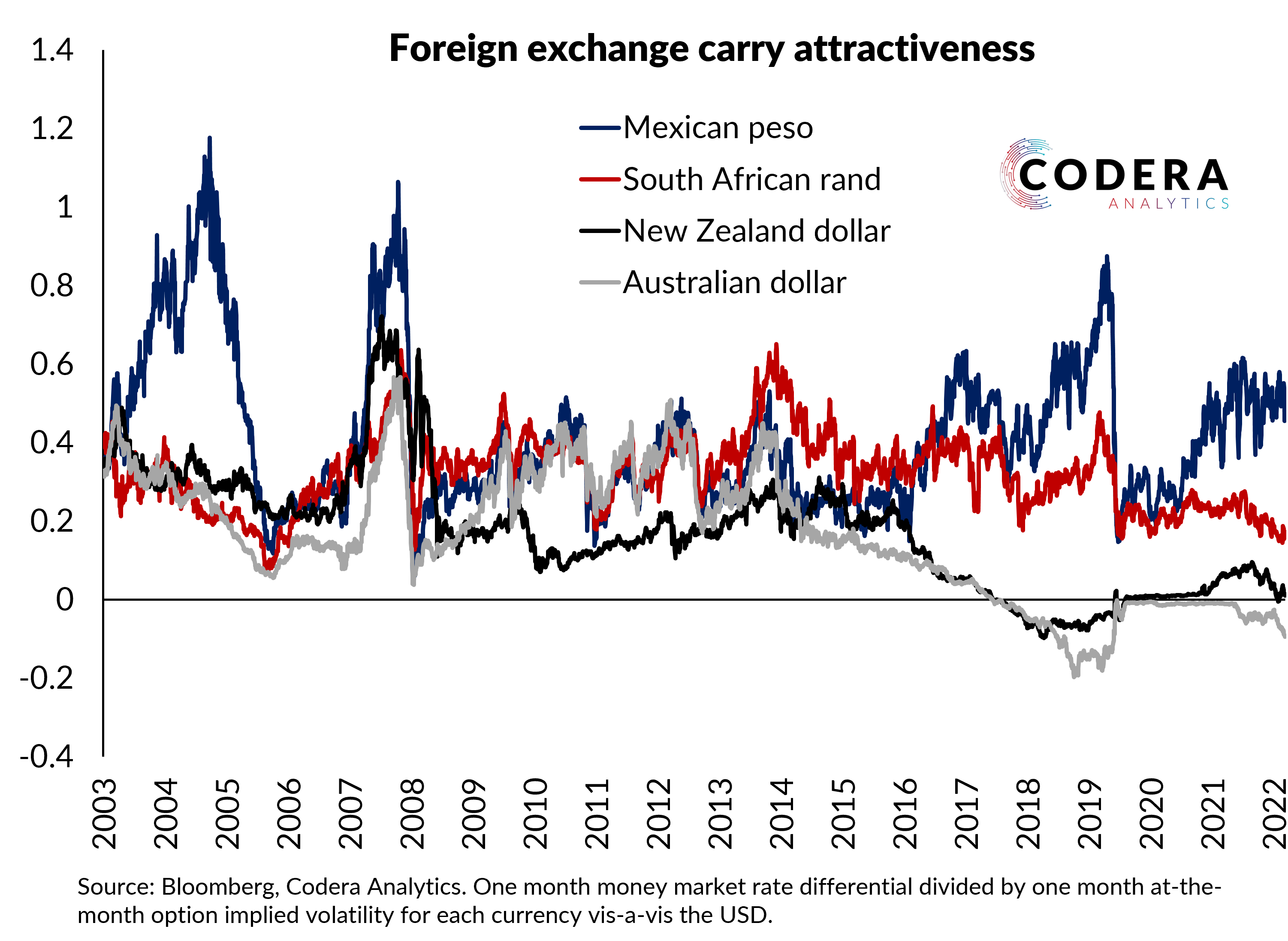

Carry trades involve investors funding investments in low interest rate economies and investing in high real interest rate economies. The rand has historically generated attractive carry returns. But with interest rates rising in funding economies like the US, the extra yield from putting funds in the rand has been eroded over recent months. On the other hand, borrowing US dollars to buy Mexican pesos has delivered higher returns, given a faster rise in Mexican interest rates and a stronger peso since late 2021.