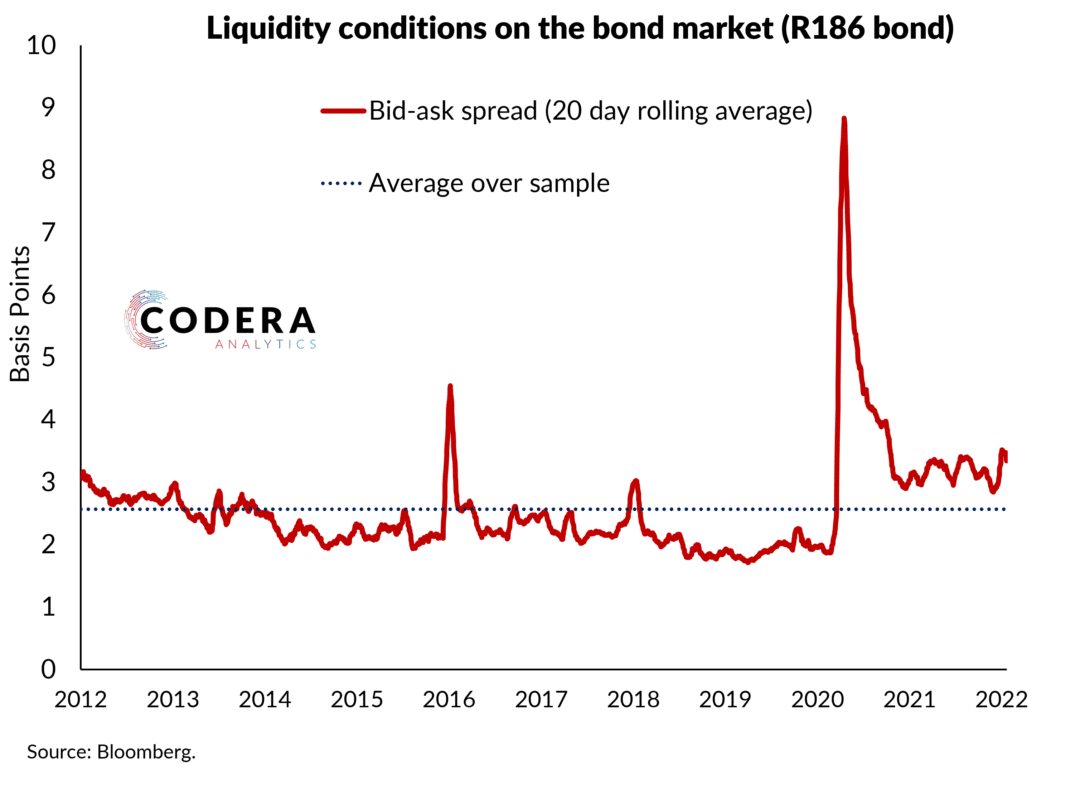

Despite historically low interest rates, the twelve month money market liquidity spread and South African TED spread (a three month measure) have been higher, on average, since 2014 and 2016 respectively. Among other things, this reflected our weakening fiscal position and requirements for banks to hold higher levels of liquid assets and stable funding. After improving in mid to late 2020 following central bank expansionary policies here and overseas, liquidity premia have been higher again since the start of 2021.