SARB announced the publication of a new interest rate benchmark, the South African Rand Overnight Index Average (ZARONIA). ZARONIA measures the rates paid on unsecured call deposits using data on transactions. The SARB has also begun publishing the South African Rand Interbank Overnight Rate (ZARIBOR) which is based on inter-bank rates. The new benchmarks are meant to represent (almost) risk-free reference rates that would be more representative of market conditions than existing benchmarks as they would be less susceptible to manipulation by market participants. By way of example, the Johannesburg Interbank Average Rate (JIBAR) is based on quoted Negotiable Certificate of Deposits (NCD) rates submitted by large banks.

The chart below shows the spreads of each of these rates to the repo (policy rate). It is striking that they are larger and more negative on average than for the SABOR, the South African Benchmark Overnight Rate.

The reason that ZARONIA has a larger negative spread than SABOR is that its calculation differs meaningfully. The SABOR is calculated based on the largest interbank deposits other than at repo and incorporates the implied rate on short-term funding in the foreign exchange swap market (which has been higher and more volatile than other overnight rates over this period). Very high and very low yields are trimmed from ZARONIA’s calculation. Although using trimmed mean calculations is not unusual in construction of reference rates, it is a methodological choice that might affect the representativeness of the measure if it excludes a large volume of market transactions. In the case of SABOR, smaller depositors that are not able to obtain better rates are excluded from the calculation. In the case of ZARONIA, the calculation excludes rates from large transactions, which means that it would overstate the spread between the policy rate and the average rate applicable to unsecured interbank transactions if large transactions tend to occur at lower rates or understand the spread if large transactions occur at higher rates (with the latter being most likely). It is a pity that an untrimmed version of ZARONIA has not published for the implications of this methodological decision to be assessed.

The large negative spread to the policy rate likely reflects the impact of SARB’s requirement that banks place 2.5% of their total liabilities with SARB on an unremunerated basis and the penalisation of deposits in excess of banks’ quotas of excess reserves (now that the system is flush with reserves after the implementation of the new monetary policy implementation regime). It is also likely that Basel 3 regulations that encourage banks to hold higher levels of high quality liquid assets and funding on a longer term basis have affected liquidity in the interbank market.

These interest rate benchmarks are also meant to be used to assess the transmission of monetary policy and risks to the financial system. Without a longer series for ZARONIA it is not possible to assess whether policy rate changes have been reflected rapidly in the new benchmark. And since the repo is secured, it is important that secured benchmark rates are also published to enable monitoring of whether policy changes are being reflected in market conditions. SARB is planning to publish ZASFR, the South African Secured Overnight Financing Rate, a secured overnight benchmark, but has not made it available as yet.

Having more representative overnight rates available may encourage the development of a tradable overnight rate overnight indexed swap market that would help with the pricing of financial market derivatives in South Africa. By providing enhanced ability to measure financial market premia, this would also enable expectations of monetary policy to be more accurately measured using financial market prices.

Lastly, reference rates are used as proxies in the estimation of bank funding costs, and the methodological choices made in their calculation might affect whether they would reflect changes in banks’ marginal funding costs. It would be great if SARB would publish more data to enable bank funding costs to be estimated more precisely at bank-level for detailed monitoring of the transmission of policy and stability of the financial system on an ongoing basis.

Footnotes

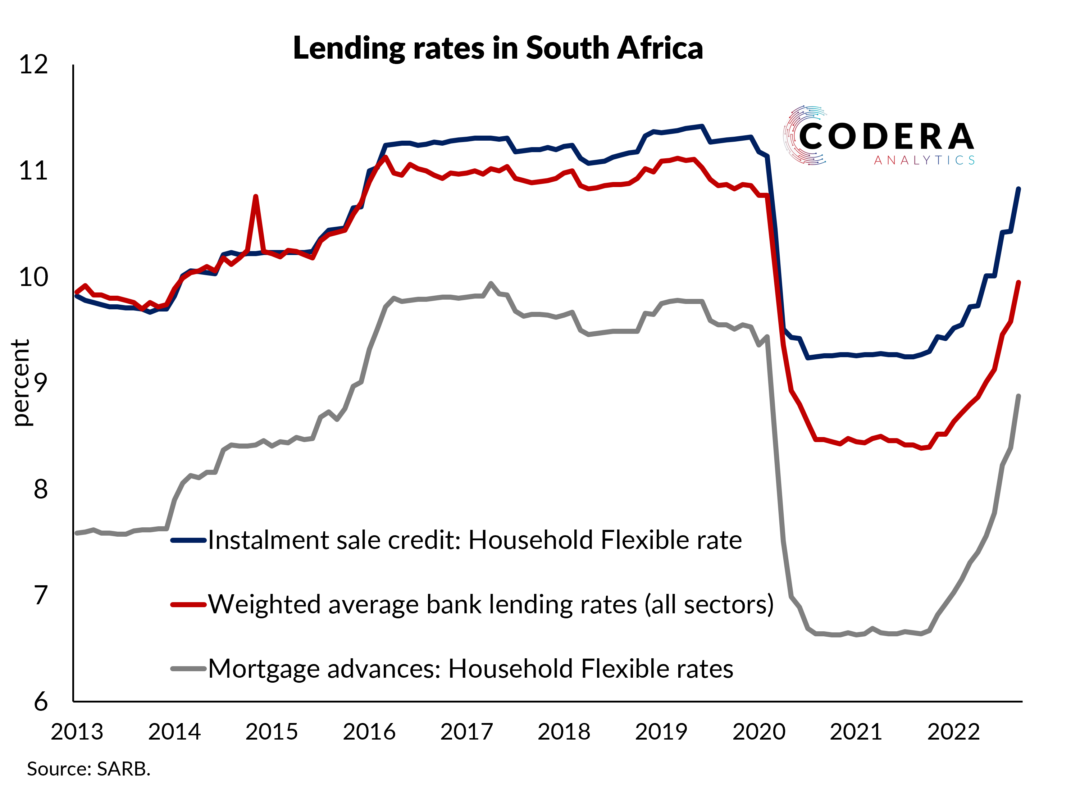

The narrowing of the SABOR-repo spread over the long term likely reflects regulatory frictions that placed upward pressure on funding cost (here and here). The net stable funding regulations, for example, served to increase banks’ funding costs by increasing the duration of banks’ funding liabilities and the relative cost of deposit funding. Together with the liquidity coverage ratio regulations, these requirements induced banks to pay more for corporate cash in light of its favourable regulatory treatment. What is unusual about South Africa relative to major advanced economy banking systems, is that weighted average bank funding costs in South Africa are low relative to reference rates, reflecting the high share of deposits in bank funding and low average relative rates on such deposits (particularly on-call deposits). In other banking systems, such as Australia and New Zealand, deposit rates have tended to be above reference rates. One cannot estimate the contribution of the Basel regulations to the observed shift in money market spreads without detailed data on the transactions in the money market.