A recent DNB working paper estimates that, in the US, potential output is independent of trend inflation when trend inflation is below a level of 4%, but that potential output is negatively affected by trend inflation above 4%. They estimate that above that threshold, potential output falls by 1 percentage point for every percentage point increase in trend inflation.

This finding is noteworthy for at least two reasons. The estimated threshold is lower than other studies have suggested previously and the impact of higher inflation on growth is more material.

This result also suggests that monetary policy models need to consider the possibility of time variation in trend inflation and non-linearity in the trade-off between output and inflation. Neglecting these possibilities when using models to assess the state of the business cycle could lead to inappropriate judgments about the right stance of monetary policy to achieve the central bank’s inflation target.

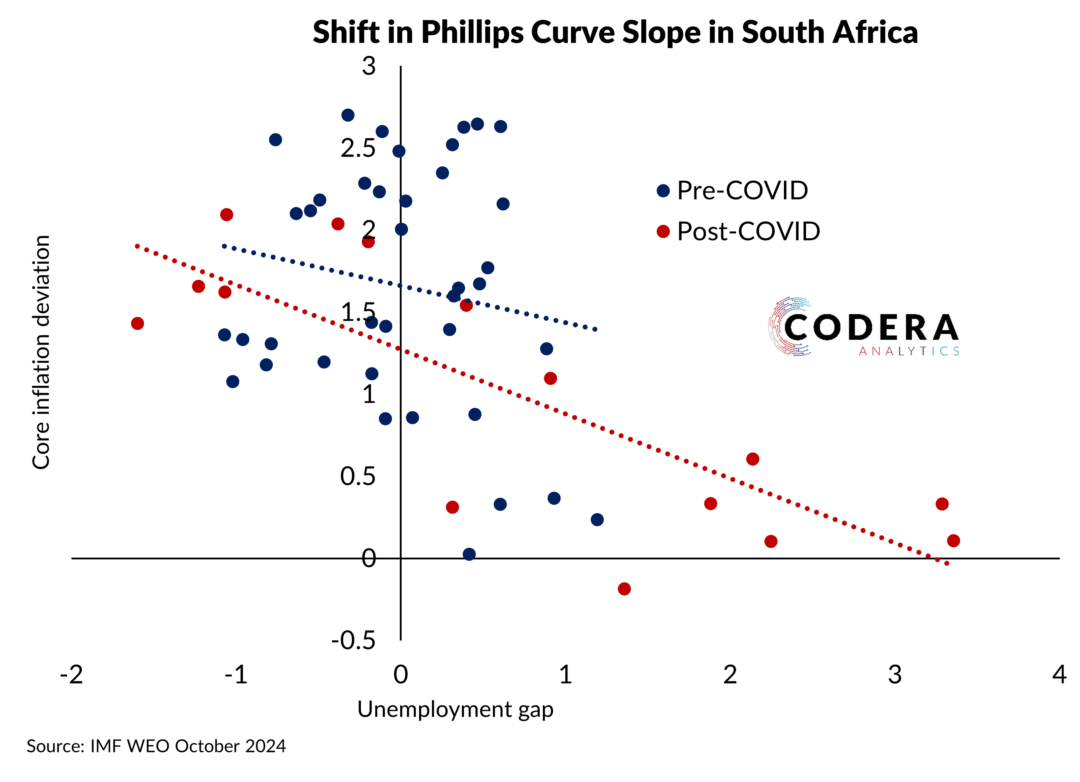

In a previous post, I showed that there does not appear to be such a threshold in the long-run relationship between inflation and economic activity in South Africa. Instead, the relationship is negative in South Africa, irrespective of the level of inflation (not just above a 4% threshold as in the US). Consistent with the findings from the paper, our modelling results implied that economic growth has not been sustainably boosted by tolerating a higher rate of inflation. The paper’s findings are also consistent with our argument in this paper that the central bank’s model for assessing the implications of capacity pressure for inflation and interest rates should be regularly re-estimated.