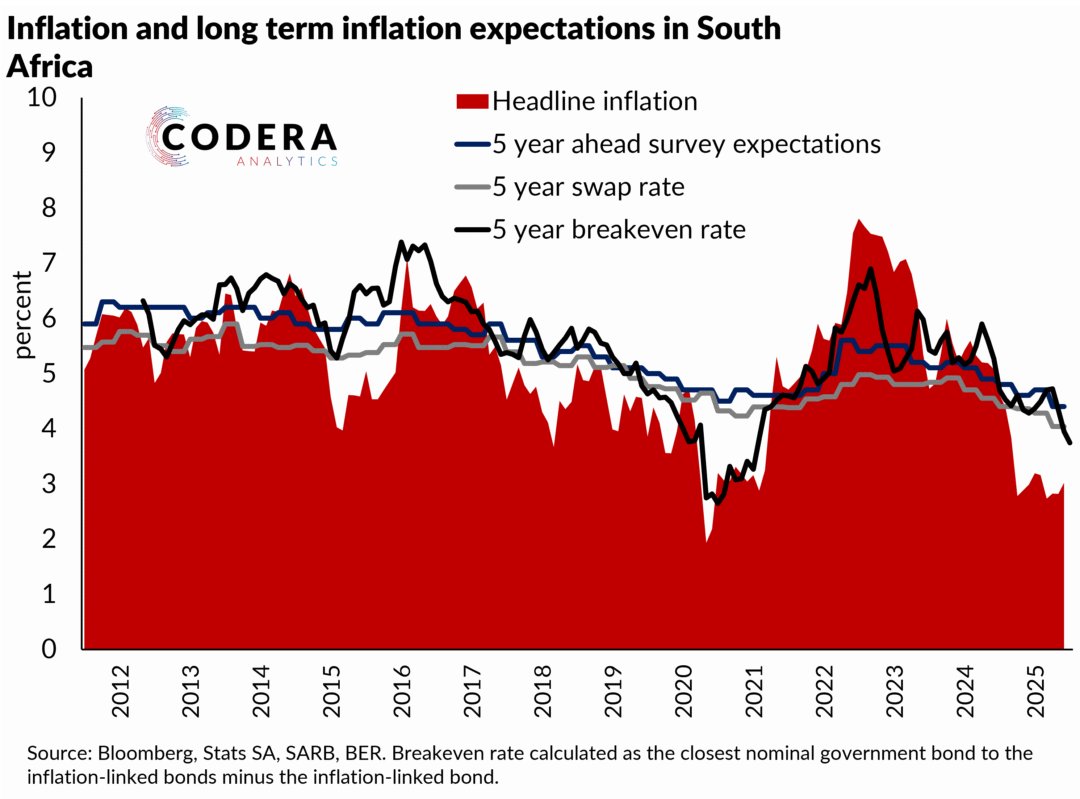

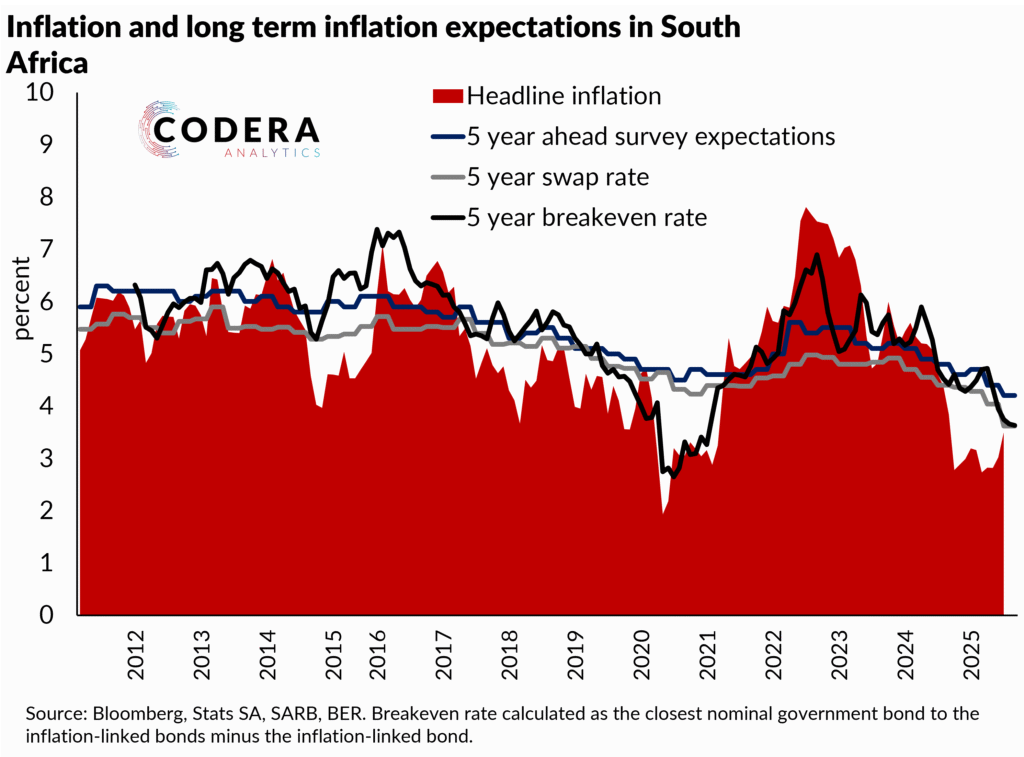

SARB’s MPC shifted the de facto inflation target to 3% in July and forecasted a lower policy rate under the assumption that inflation expectations will rapidly adjust downwards. Today’s post compares headline inflation and survey-based and market-based long term measures of inflation expectations in South Africa. Inflation expectations are continuing to decline, but as we have argued in several earlier posts (here and here), it has historically taken extended periods of below de jure target inflation to bring expectations down.

Footnote

Note that breakevens may not provide an accurate read on inflation expectations in South Africa as they are also driven by factors beyond market inflation expectations (such as liquidity premia) and South African only the principal is indexed for inflation for South African linkers, unlike linkers of other sovereigns.