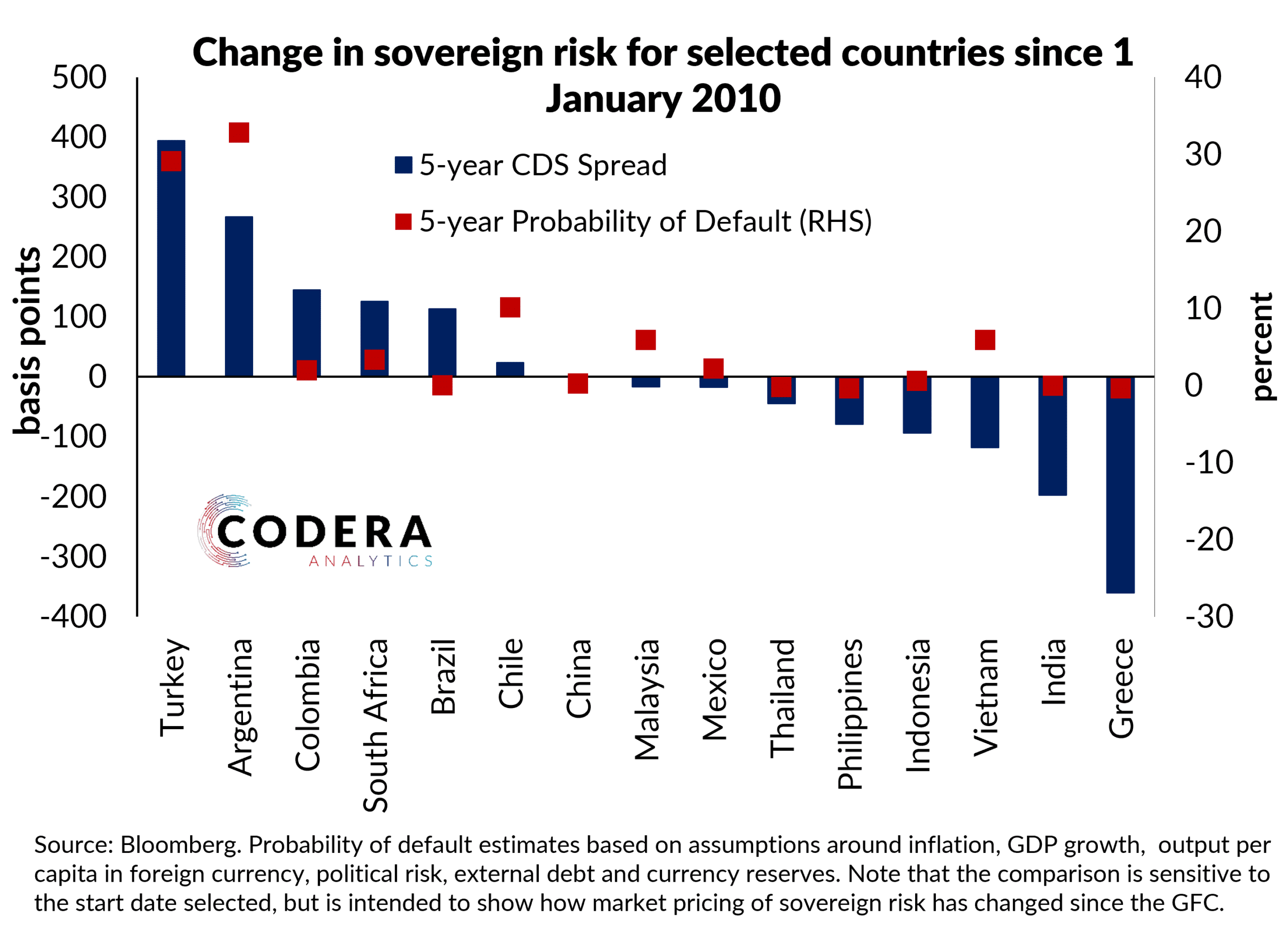

Market pricing of South Africa’s sovereign credit risk is meaningfully higher since 2010 (5-year CDS spread up over 100 basis points) and the probability of default embedded estimated using Bloomberg’s model has risen by around 3 percentage points to over 10% at a 5-year horizon. This is less than for Turkey and Argentina, but more than for many other emerging markets for which data are available.