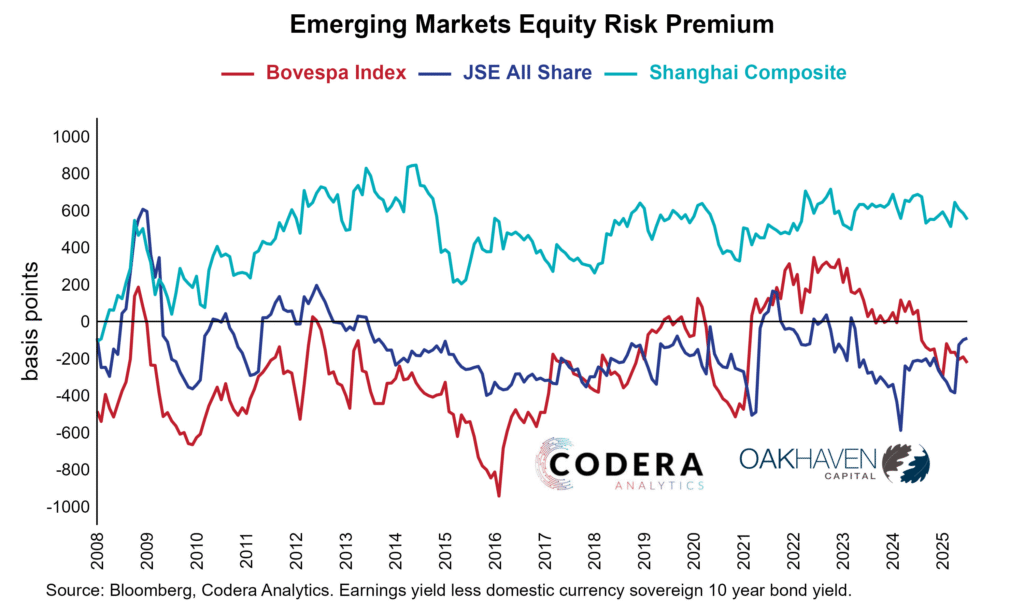

Equity risk premia measure the extra return investors demand for holding stocks over ‘risk-free’ government bonds, and the story differs sharply across emerging markets. Whereas US and UK stocks have historically offered attractive returns relative to sovereign bonds, the opposite has been true in South Africa. Today’s post by Takudzwa Mutetwa shows that China’s equity markets have offered a meaningful buffer over its sovereign bond yields, on the other hand. In South Africa and Brazil, high bond yields imply that investors have received little to no additional compensation for equity risk. It is worth pointing out that there are many ways to measure equity risk premia (see some alternatives here, here and here) and that South African stocks are dominated by offshore companies, distorting the comparison somewhat. We discuss some of the macroeconomic implications of this here and here.