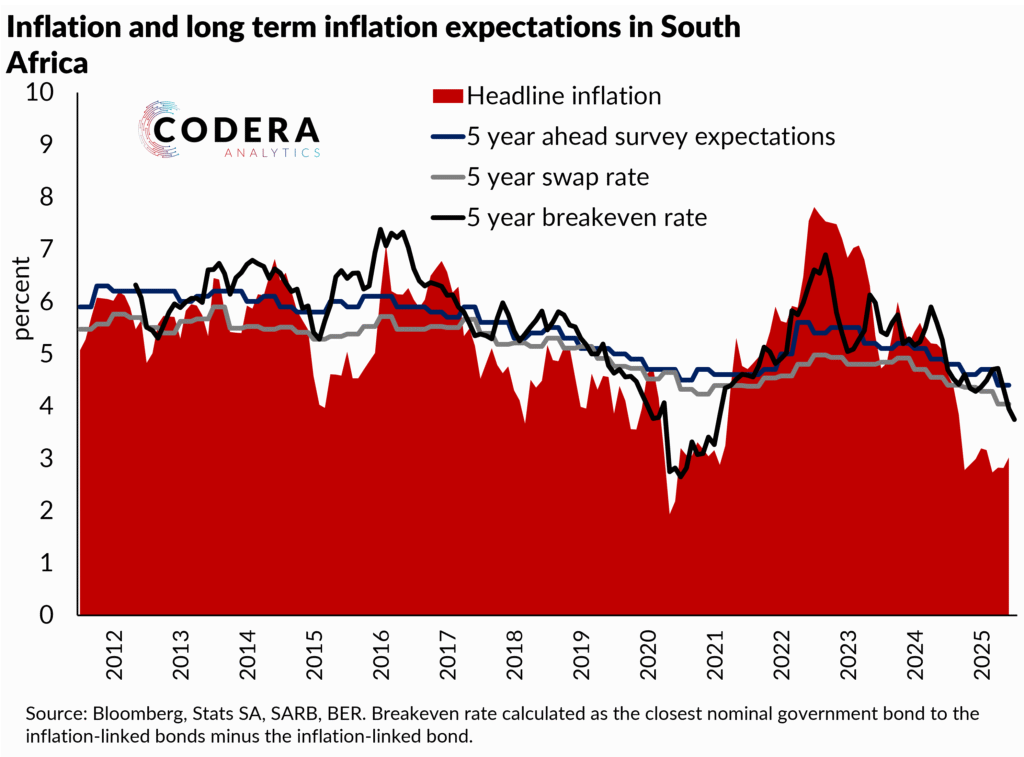

The SARB Monetary Policy Committee recently signaled that it would now prefer a lower 3% interpretation of their inflation target and forecasted a lower policy rate under the assumption that inflation expectations will rapidly adjust downwards. Analysts are closely tracking how inflation expectations evolve to assess whether SARB’s assumptions are reasonable and therefore the adjustment path it has laid out is likely to bear out.

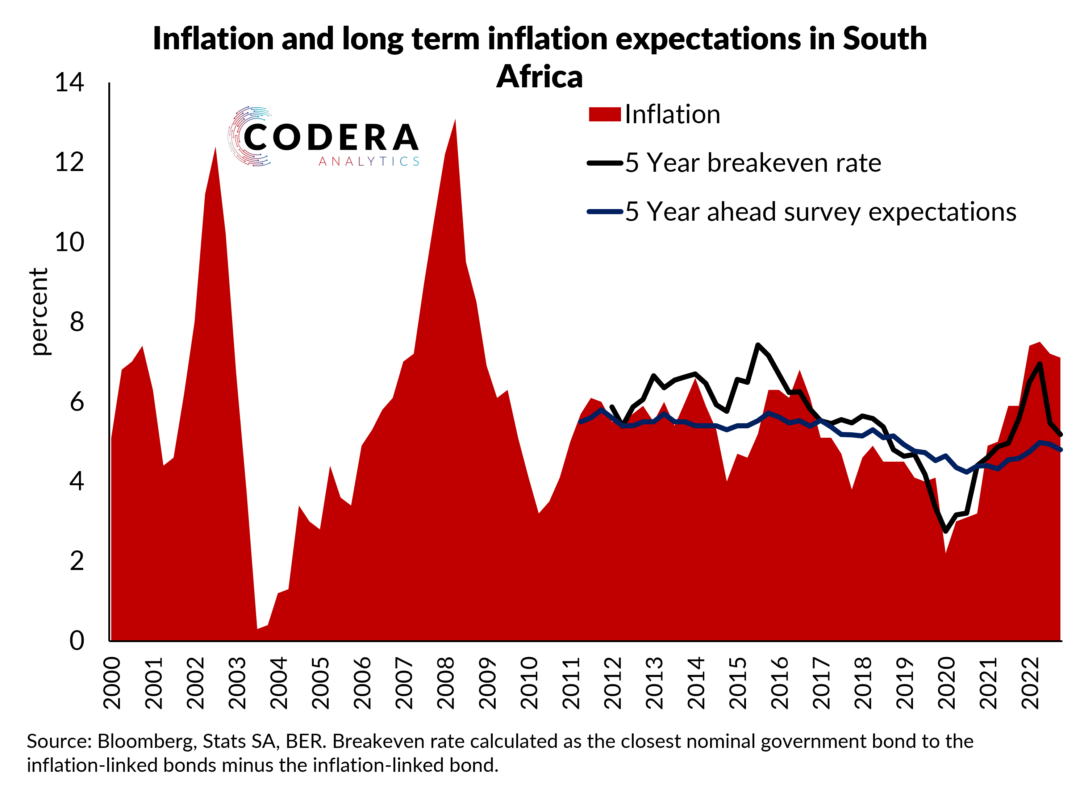

Today’s post compares headline inflation and survey-based and market based long term measures of inflation expectations in South Africa, which have declined slightly but remain above inflation outcomes.

Footnote

Note that breakevens may not provide an accurate read on inflation expectations in South Africa as they are also driven by factors beyond market inflation expectations (such as liquidity premia) and South African only the principal is indexed for inflation for South African linkers, unlike linkers of other sovereigns.